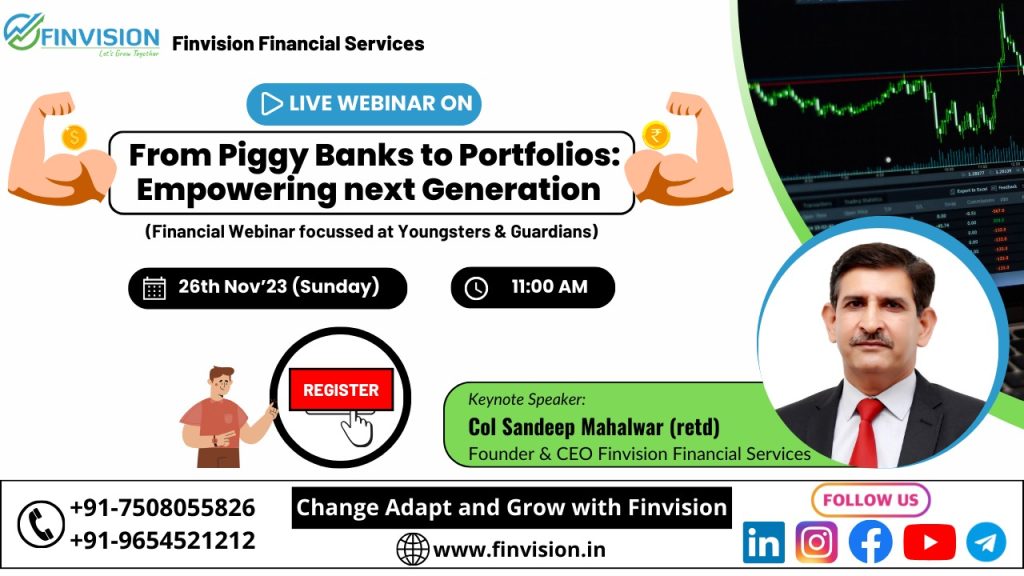

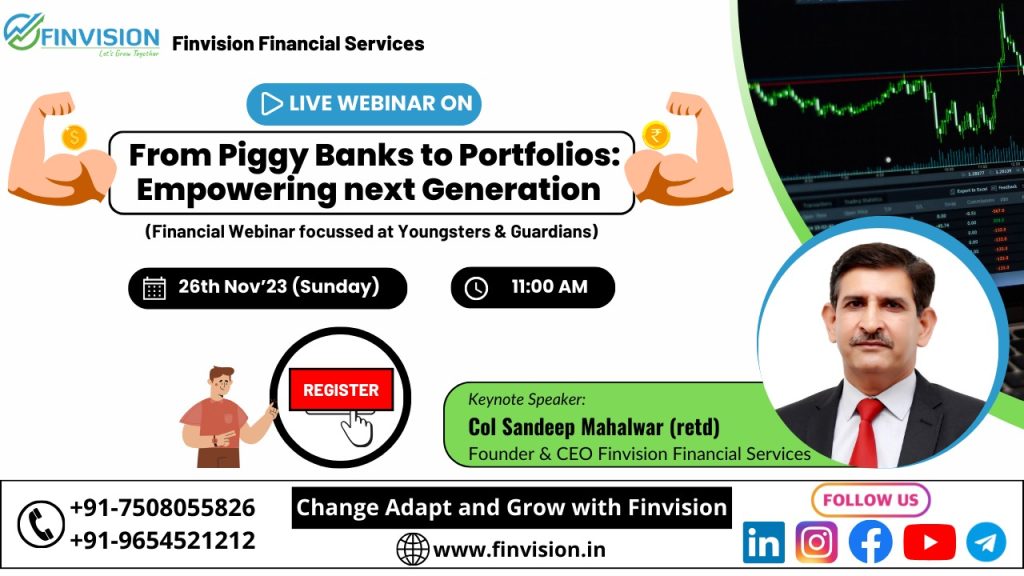

Financial Webinar (November)

Calling all Young trailblazers and parents/guardians for the upcoming FINVISION Webinar, as this can give YOU and YOUR CHILD a head start in financial literacy. 👉 Who can get benefit from this Webinar? ✅ Parents and guardians looking to guide their youngsters towards financial success. ✅Youngsters eager to take control of their financial journey. 👉 Why should you join? ✅Learn how […]

Why are Mutual Funds subject to Market Risks?

Whenever you watch mutual fund advertisements on television, in the end, they show a disclaimer: “Mutual Fund investments are subject to market risks, read all scheme-related documents carefully”. What does it mean? What are the market risks that mutual funds carry? What are the market risks that are associated with equity and debt funds? People invest […]

Volatility: A filter that separates the Real investors from the Ignorant ones

Market volatility is part of the investment landscape, but short-term shifts don’t always reflect an investment’s true value. Resisting the urge to make snap decisions during uncertainty can protect us from unnecessary losses and ensure a stable financial future. Trust in our long-term investment strategy and stay focused on your goals. Have a look at […]

The best investment option & strategy for your regular income needs

👉Is it possible to earn an income through your investments? 👉How can you keep making money yet never run out of your corpus? You must have heard about SIP, however one should also be aware of SWP (Systematic withdrawal plan). As we nears retirement phase, we need to plan how we wish to withdraw the […]

5-Point Financial checklist to prepare & 4-Red flags to avoid for Retirement

Retirement planning can seem like an elusive financial goal for most of our working lives. However, as we approach our 50s, it suddenly becomes a reality. The burning question on everyone’s mind is, “How should I prepare for my retirement?” At Finvision, we understand the importance of this question for the fraternity and are here […]

Mitigating Risk with Finvision

You’re probably no stranger to the oft-repeated caution: “Mutual Fund Investments are subject to market risk. Read all the schemes…”. Indeed, every investment venture carries an inherent degree of risk. However, it’s crucial to understand that risk itself isn’t an entity to dread. Rather, it just signifies an inherent uncertainty in outcomes. The silver lining here […]

Plan today, prosper tomorrow with SIP!

Ready to experience the #Finvision advantage? Reach out to us today at +91-9654341212 or Email Id: info@finvision.in to schedule a consultation and we shall help you navigate market volatility and unlock your full financial potential. Have a look at what our Investors are saying about us👉

Retirement Benefits(for armed forces officers)

Greetings, Whether you’re in service or retired and planning for a financially stable future, this video has got you covered. This informative YouTube video covers the crucial topics of: 1. Pensionary entitlements 2. Lumpsum benefits at the time of PMR/ Superannuation 3. Wealth creation through commutation of pension 4. Finvision 2 Bucket strategy for regular […]

5 Reasons why you must choose #Finvision

“Right asset allocation is always the key to investment returns” Thank you for your continuous encouragement and support to Finvision Financial Services. At Finvision, we are passionate about the attainment of our investor’s financial goals by providing the best and unparalleled growth opportunities. In today’s dynamic financial landscape, where markets can be as unpredictable as […]

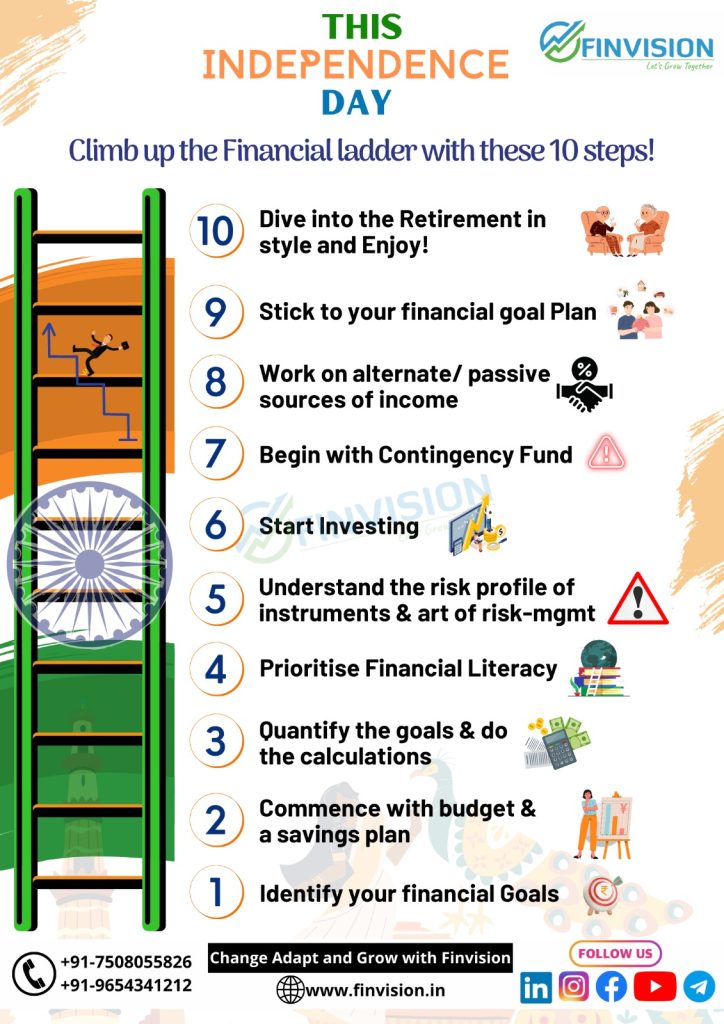

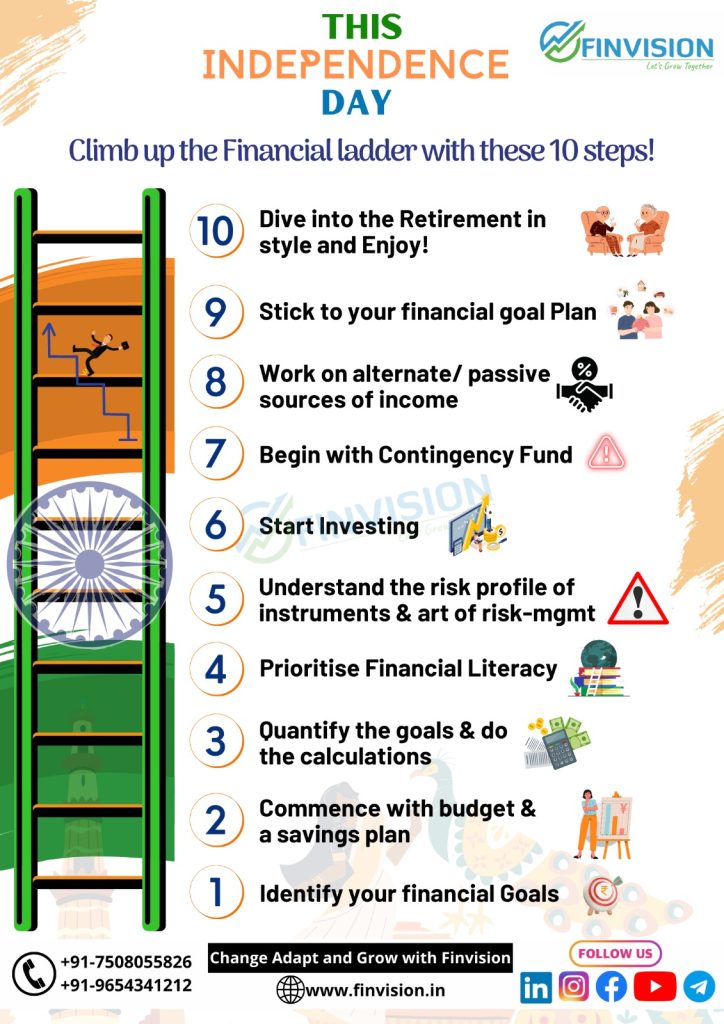

10 steps to climb up the Financial Independence ladder

Financial Independence refers to being in complete control of your finances. Being financially secure is a concept that must be on everyone’s to do list. You must set an age limit by which you want to attain financial freedom and adopt measures to achieve that. Attaining financial independence has many benefits and helps you in […]