“Right asset allocation is always the key to investment returns”

Thank you for your continuous encouragement and support to Finvision Financial Services. At Finvision, we are passionate about the attainment of our investor’s financial goals by providing the best and unparalleled growth opportunities.

In today’s dynamic financial landscape, where markets can be as unpredictable as they are rewarding and equity markets have made a turnaround for the better in the last 3-4 months, taking key indices of BSE Sensex and the Nifty 50 to their all-time highs. Engaging with a reliable financial expert to manage your investments is paramount. At #TeamFinvision, we are committed to guiding you through the highs and lows of the market while consistently delivering exceptional risk-adjusted returns. Our belief in strategic planning and periodic realignment of assets, has continuously resulted in remarkable gains for our investors.

Here are 5 Solid reasons for you to choose Finvision:

1. Focus on customized services and sound fundamentals: One of our key features is customization at the individual level and focus on quality. We invest only in quality instruments that have strong fundamentals and are well-positioned for growth. This helps us reduce the risk, while still providing the potential for significant growth.

2. Continuous monitoring and periodic re-alignment of portfolio: From Equity, Gold, Debt, corporate bonds, real-estate(REITs), Large-Cap, Mid-Cap, Small-Cap, Value and Sector-specific stocks, our portfolios are well-diversified to capture opportunities across market sectors, evolving market cycles & investment themes. Dynamic portfolio realignment strategies are positioned to benefit from the cyclical recovery of the Indian Economy.

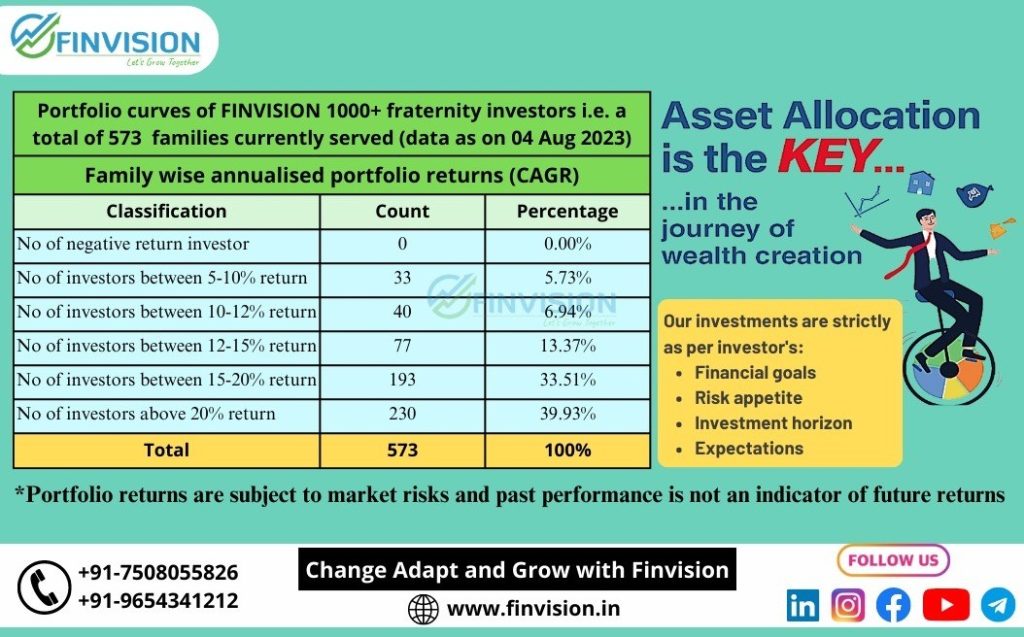

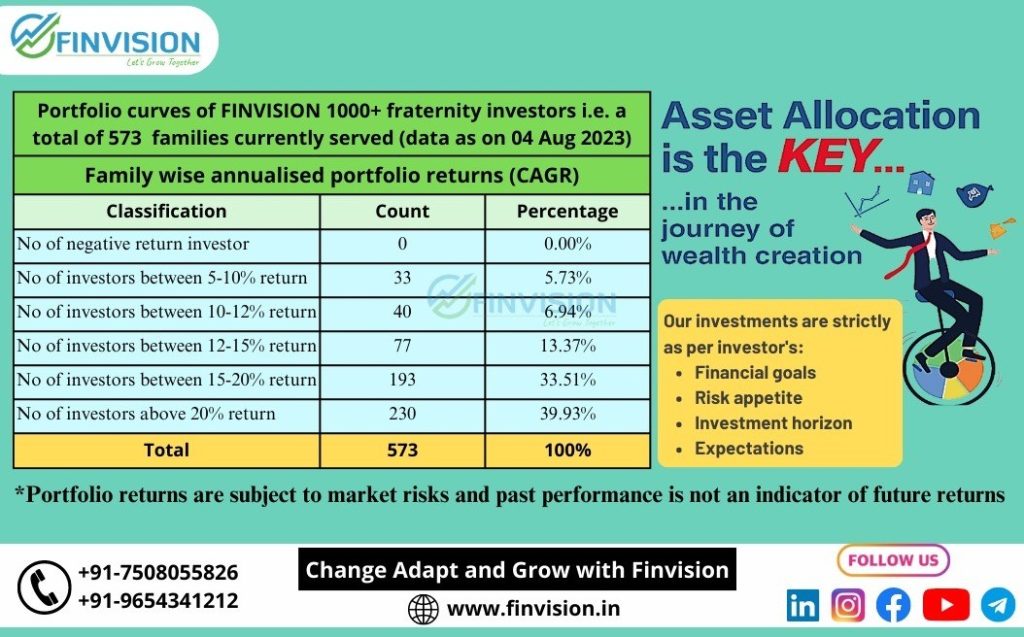

Annualised Portfolio returns of the 573 families served by Finvision are as under:

3. Robust track record: A track record of success is a testament to an advisor’s capabilities. Over the years, we’ve guided 1000+ investors (500+ families) through various market conditions, consistently achieving the most optimal risk-adjusted returns. As can be seen from the above table, we at #Finvision have consistently delivered an annualised growth rate of more than 15% to 73.44% of our investors. This is a testament to our commitment to your financial well-being is unwavering, and our results speak volumes about the effectiveness of our strategies.

While past performance is not indicative of how the investments will perform in the future, our investors’ portfolios have a robust track record since their inception and across market cycles, and time frames.

4. Expertise that matters: Navigating the complexities of today’s financial landscape demands a deep understanding of markets, trends, and investment strategies. Our data-based decision-making and seasoned professionalism give you access to a wealth of knowledge that ensures your investments are in capable hands. We leverage this expertise to make informed decisions that align with your risk appetite and financial goals.

5. Emphasis on risk management: While returns are enticing, preserving your hard-earned capital is equally crucial. We remain dedicated to risk management and diligently analyse potential risks associated with each investment and investment opportunity. By making considered and calculated decisions, we continue to protect your investments against market downturns while optimizing growth potential.

To know more, register for Finvision 27 Aug 2023 Webinar on “Financial and Retirement Planning”, specifically tailored for armed forces officers and families: https://forms.gle/uZhpGuU4eSJeRFTK9

Are you ready to experience the Finvision advantage? Reach out to us today at +91-9654341212 or Email Id: info@finvision.in to schedule a consultation. Let us show you how we can help you navigate market volatility and unlock your full financial potential.

Have a look at what our Investors are saying about us 👉

Link to join the ‘Finvision Frontline’ telegram group and stay updated: https://t.me/RMiB6j1HPec1ZjVl