You’re probably no stranger to the oft-repeated caution: “Mutual Fund Investments are subject to market risk. Read all the schemes…”. Indeed, every investment venture carries an inherent degree of risk. However, it’s crucial to understand that risk itself isn’t an entity to dread. Rather, it just signifies an inherent uncertainty in outcomes. The silver lining here is that risk can be effectively managed.

Two sides of a coin: This brings us to the pivotal point that investors must grasp the concept of investment risk and the process of risk profiling. In simpler terms, investment risk boils down to the uncertainty surrounding an investment’s performance. The classic question of “Will my investment yield gains or losses?” frequently haunts investors. Measuring investment risk involves assessing the likelihood of incurring losses. Risk is pervasive. It accompanies us while crossing a street, travelling, flying, and of course, while investing. Just as we’re advised to look both ways before crossing a road, it’s paramount to evaluate investment risks before committing funds.

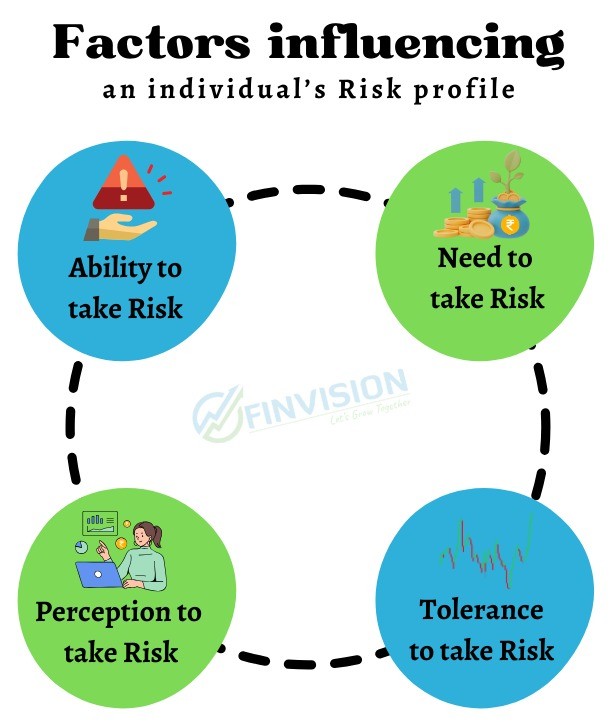

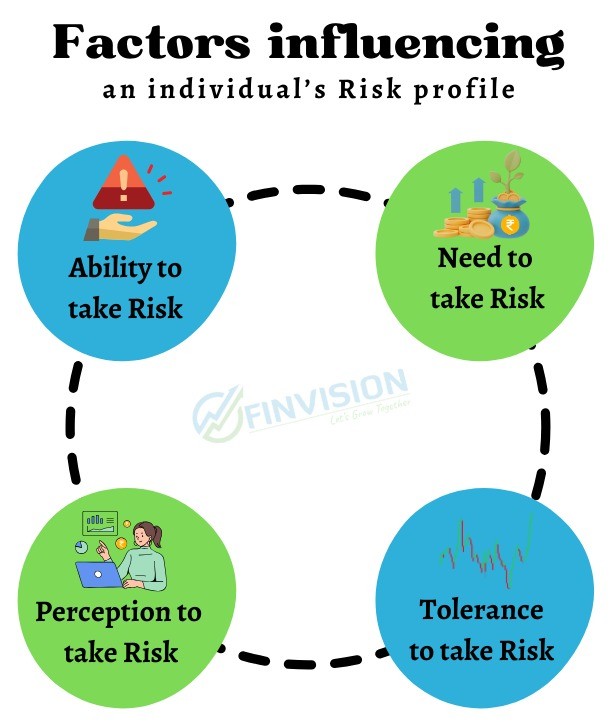

What is your Risk profile? The crux lies in aligning one’s personal risk profile with the inherent risk of an investment. This is where risk profiling comes into play, a process that aids individuals in comprehending and gauging their capacity and willingness to undertake risk. Risk assessment and profiling are integral to the investor’s investment journey. Some key factors influencing an individual’s risk profile are:

1. Ability to take Risk: This refers to an investor’s readiness to accept risk across different life stages. An individual’s current income, assets, and liabilities significantly influence their capacity to embrace risk. For instance, a salaried employee with a stable job, consistent income, and tangible assets like a house will likely possess a higher risk tolerance than someone with uncertain income and no assets.

2. Need to Take Risk: Balancing one’s current expenses, future obligations, and financial aspirations is key. The need to undertake risk is closely linked to how one’s income and investments can propel them towards their financial goals.

3. Perception of Risk: A behavioural factor, this dimension is deeply personal and can fluctuate over time. It centres on how an individual perceives and reacts to risk, especially during volatile market conditions.

4. Risk Tolerance: Another behavioural facet, this element encapsulates an individual’s comfort level with assuming risk. Even if someone possesses a high ability and needs to undertake risk, they might inherently lean towards risk aversion.

Fortunately, the services of a good financial advisor can be enlisted to evaluate these factors accurately and derive a precise risk profile, as they keep track of market trends, economic indicators, and fund-specific factors that may impact the investment along with educating investors about the fundamentals of investing, including their benefits, risks, costs and provide guidance on investment strategies, asset allocation, and long-term planning.

In conclusion, the financial and investment landscape is full of risks, but embracing them through prudent risk management can transform these uncertainties into opportunities for growth. By deciphering one’s risk profile, investors can embark on a journey tailored to their unique circumstances, making strides toward their financial ambitions while maintaining a sense of security.

Our commitment to your financial success is what sets us apart. We at Finvision Financial Services, customize investments as per your Financial goals, Risk appetite and investment horizon. Choose Finvision today as your financial advisor, and let us illuminate the path to a secure and prosperous future together.

To know more, register for the #Finvision 24th September 2023 Webinar on “Financial and Retirement Planning”, specifically tailored for the armed forces officers and their families: https://forms.gle/BS9nAA8bS4fT6Rkz9

Reach out to us today at +91-9654341212 or Email Id: info@finvision.in to schedule a consultation. Let us show you how we can help you navigate market volatility and unlock your full financial potential.