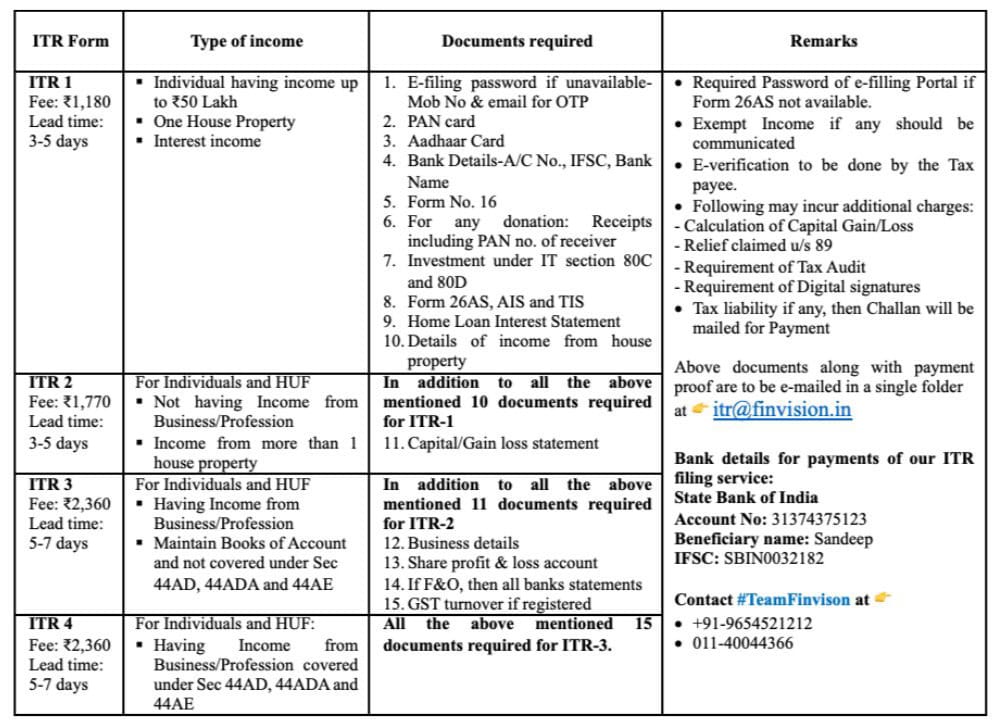

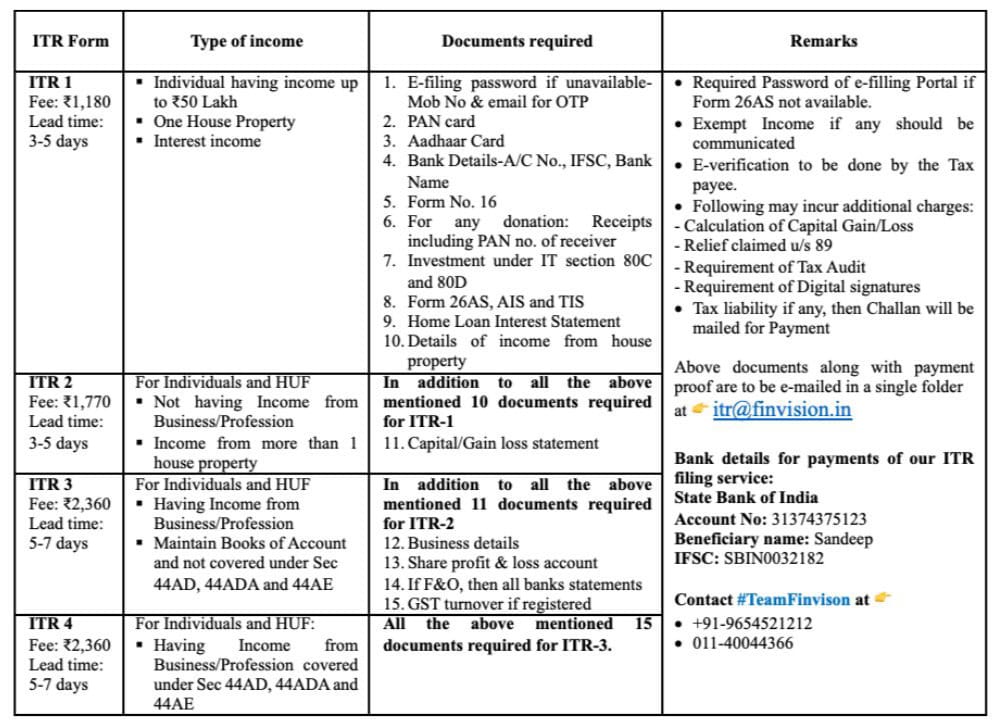

2. The process for the same is as under:

Payment can also be done via using UPI payments.

UPI Id: 7508055826@paytm

(Kindly enclose the payment reference/ proof with the documents for ITR filing, and all queries should be shared only through email I’d: itr@finvision.in)

3. Important Note for Retired Officers:

In case you have retired between 01 Apr 2022 and 31 Mar 2023, or have received full or part of your retirement corpus during this period, please provide us with the following details:-

(a) Total retirement emoluments received during the period 01 Apr 22 to 31 Mar 23 including Leave encashment, Gratuity, Commuted Pension, AGIF/NGIS/AFGIS corpus, and DSOPF. Though all of these are tax-free, they need to be reflected in your ITR.

(b) The one-time payment made towards ECHS deducted from gratuity is eligible for a tax benefit of ₹25-50K under IT Sec 80D.

(c) In case you are in receipt of a disability pension, kindly make mention of the same in your email for us to factor it.

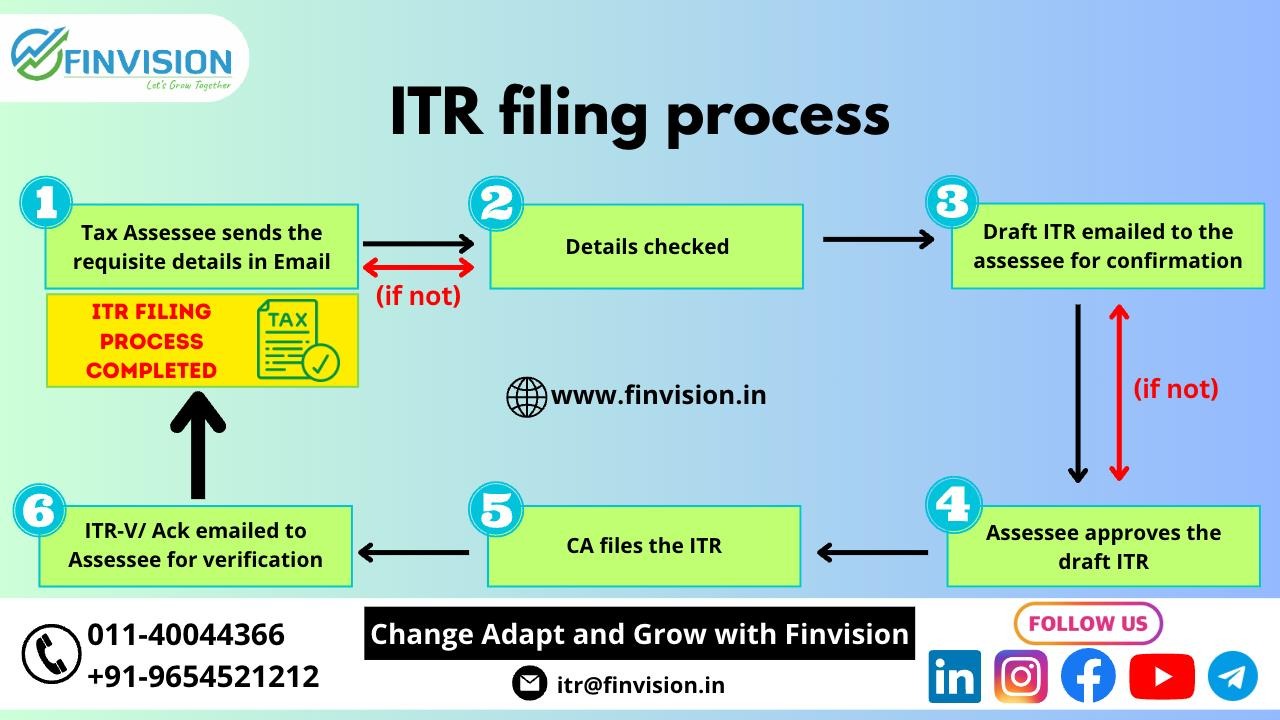

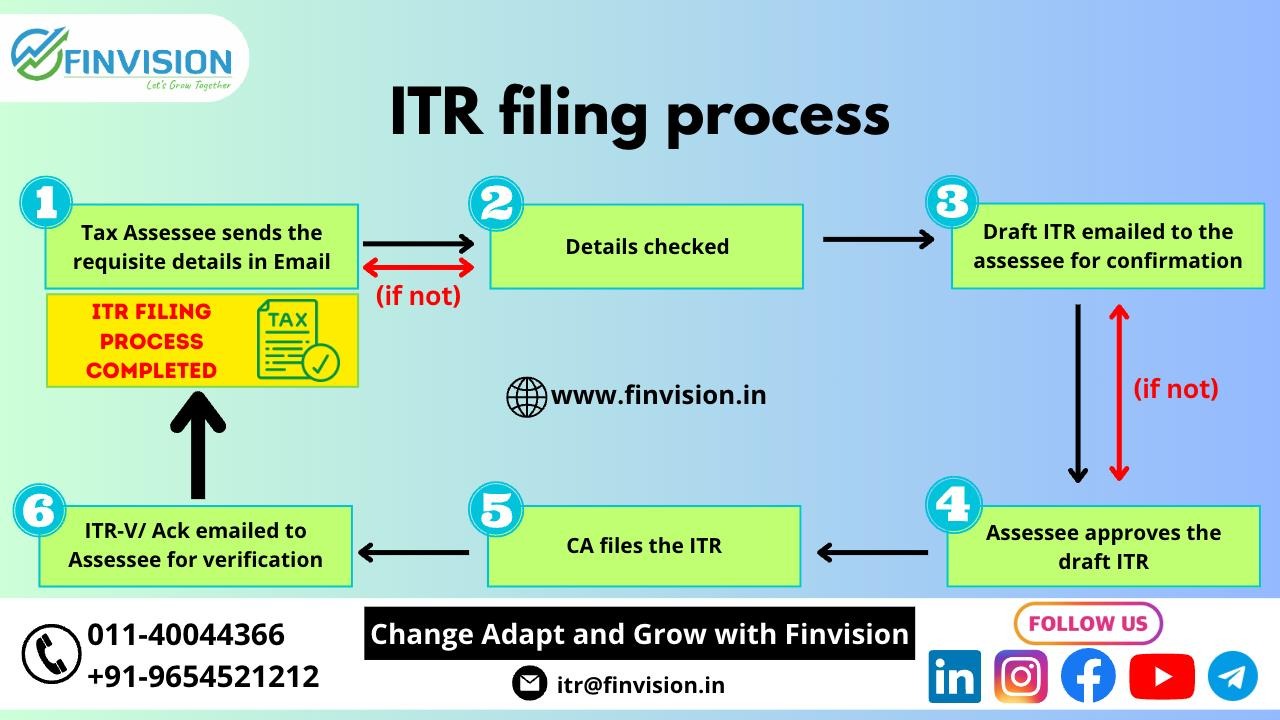

Once complete details as per columns 3 and 4 of the above table are received through email at itr@finvision.in, the broad steps of the procedure are:

A YouTube link to our video on IT returns and which regime you should be choosing is also enclosed: https://youtu.be/sJsUktvdio0

Note: Early filing of the ITR will enable a timely refund of extra taxes deducted and would avoid penalties and interest on the tax dues, if any.

For all your smart and customised Financial/ Retirement Planning, Investment, Insurance and Tax optimising needs, contact #TeamFinvision at +91-7508055826/ 9654341212 or email us at info@finvision.in