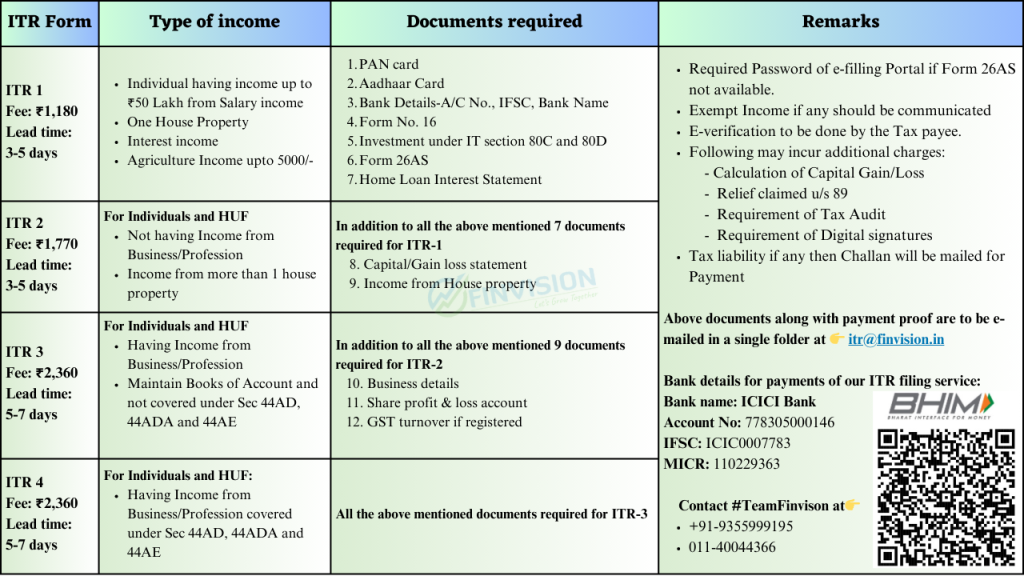

We at FINVISION have commenced with filing the IT Returns for the current year.

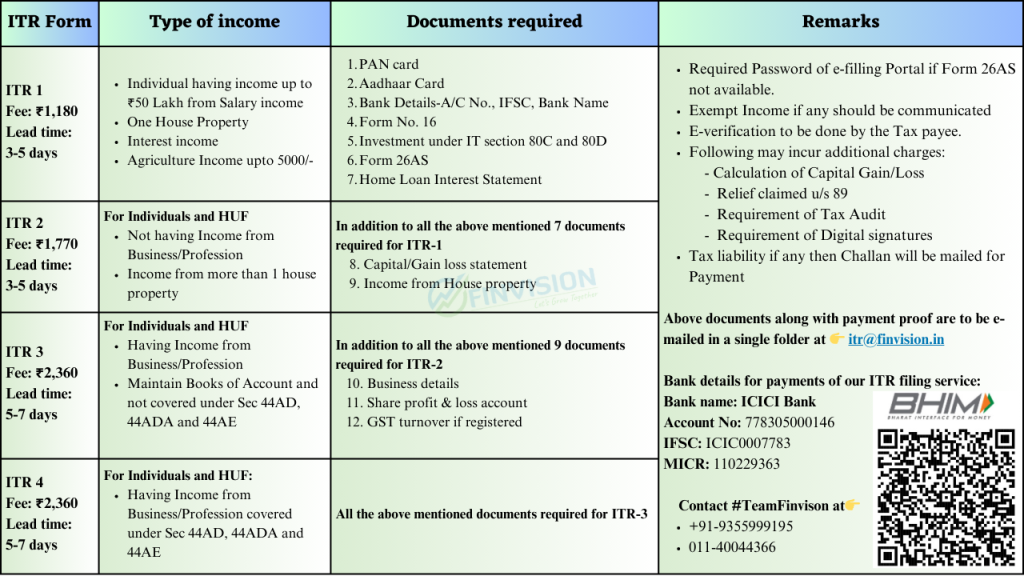

The process for the same is as under:

(Kindly enclose the payment proof with the documents for ITR filing)

All queries to be addressed only at itr@finvision.in or 011-40044366/ 9355999195.

Important note for Retired Officers:

In case you have retired between 01 Apr 2023 and 31 Mar 2024, or have received full or part of your retirement corpus during this period, please provide us the following details:-

- Total retirement emoluments received during the period 01 Apr 23 to 31 Mar 24 including Leave Encashment, Gratuity, Commuted Pension, AGIF/NGIS/AFGIS corpus and DSOPF. Though all of these are tax-free, however, these need to be reflected in your ITR.

- One time payment towards ECHS deducted from gratuity is eligible for a tax benefit of ₹25-50K under Sec 80D.

- In case you are in receipt of disability pension, kindly make a mention of the same in your email.

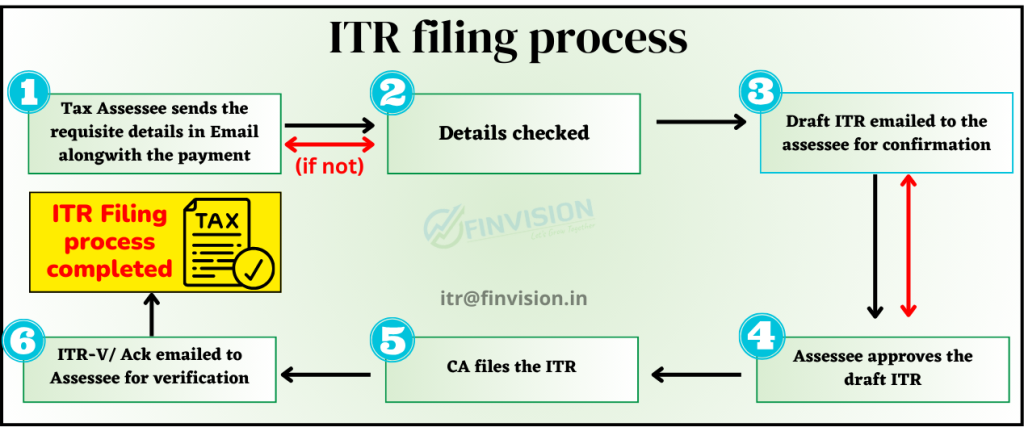

- Broad steps of the procedure of ITR filing, once complete details as applicable(as per column 3 & 4 of above Table) are received:

Please share your details on an early date to get your ITR filed.

Get in touch at +91-93559 99195 or email us at itr@finvision.in

Note: Early filing of the ITR will enable a timely refund of extra taxes deducted and would avoid penalties and interest on the tax dues, if any.

For all your smart and customised Financial/ Retirement Planning, Investment, Insurance and Tax optimising needs, contact #TeamFinvision at 9654341212 / info@finvision.in