Financial Independence refers to being in complete control of your finances. Being financially secure is a concept that must be on everyone’s to do list. You must set an age limit by which you want to attain financial freedom and adopt measures to achieve that. Attaining financial independence has many benefits and helps you in living a dream life like buying a house, world trip, living a carefree retirement life and many other goals, including setting up your own business venture.

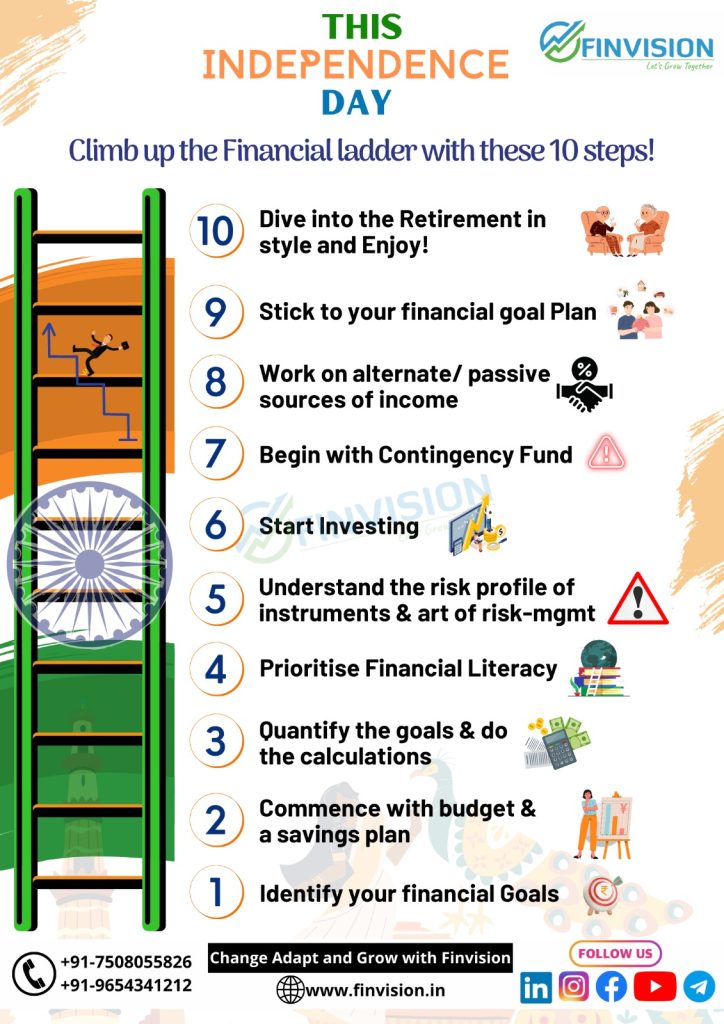

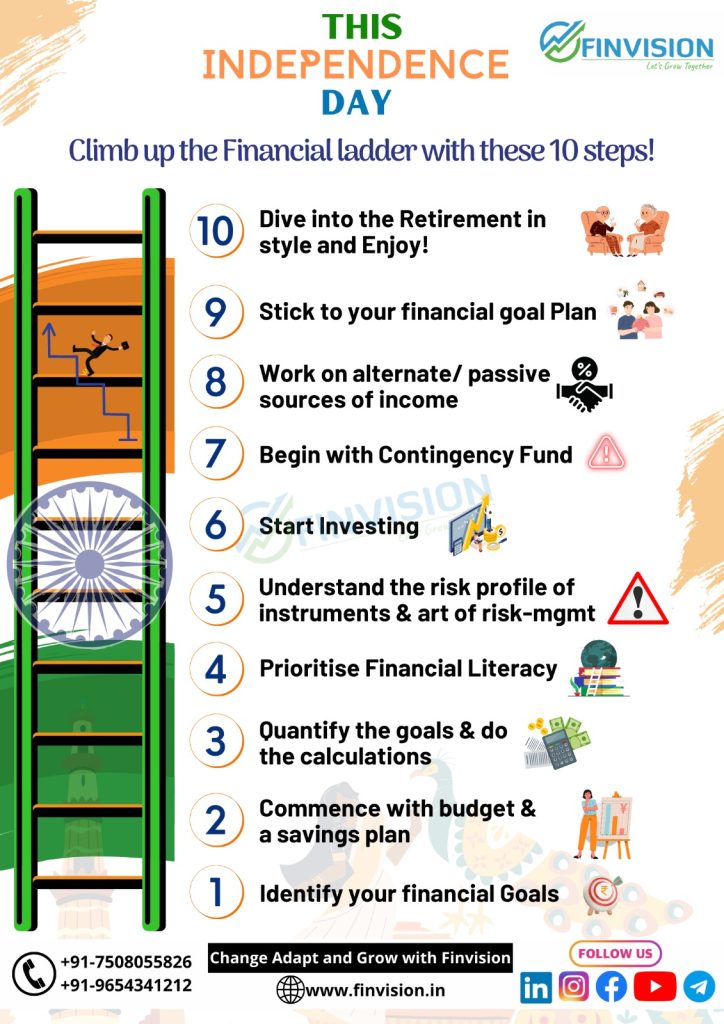

While achieving financial freedom is not an easy task, one must strive to achieve it from a young age by prudently utilising their Savings and Investment. Here are ‘FINVISION’ recommended 10 steps to attain your financial independence and work towards financial Security:

1. Identify your financial goals: Everyone has a general desire to achieve financial Independence but the first step to work towards this is to identify and set your financial goals. Determine the lifestyle that you wish to achieve and the age at which you want to achieve.

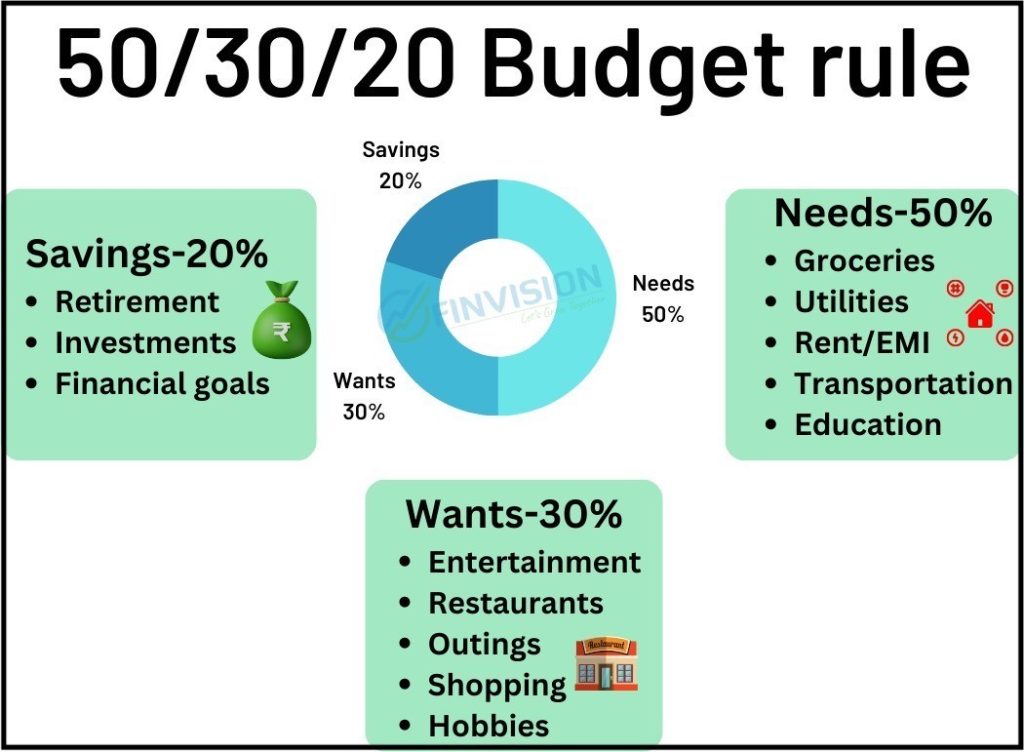

2. Commence with budget and a savings plan: Know how much you spend on a monthly or yearly basis. To identify and set a limit on your avoidable spendings and allocating resources in the pursuit of financial independence.

3. Quantify the goals and do the calculations: The next step is to do the backward calculation from your deadline age to achieve the set goals to your current age so as to establish how much time you have to attain the set goals. This will help you systematically plan your savings and investments.

4. Prioritise financial literacy: Everyone makes money but how to put your money to work is an art that not everyone can master. To learn this skill, one must learn the skills related to financial management, investment and management of personal finances. Start reading financial magazines, newspapers and newsletters, understanding the basics of the markets and reviewing relevant changes in taxation. Knowledge on the financial front is helpful in investing optimally.

5. Understand the risk profile of instruments & art of risk-mgmt: Taking known and calculated risks is one of the most important factors in achieving financial independence. Taking calculated risks helps in prudent decision making and making decisions that most people would otherwise miss. It also helps in making the most of the opportunities available to them so that wealth can be created smartly.

6. Start investing: The most underrated tip is to start investing as soon as possible. This will enable you to exploit the power of compounding and ride the short term market volatilities.

7. Begin with Contingency fund: Having an emergency fund is one of the most essential requirements. To avoid borrowing money in case of medical conditions, job loss or any other emergency.

8. Work on alternate/ passive sources of income: Having only one source of income is not sufficient. Exploit the technology and avenues of investments, to earn more income and invest. This ensures that one can maintain a standard of living while also driving the savings towards investments for the future.

9. Stick to your financial goal plan: While majority doesn’t have a financial plan and many even from those who have don’t stick to it. This hampers the process of wealth creation and becoming financially free. Sticking to a financial plan will enable tax planning, cash flow management, investment management, retirement planning and growing your wealth.

Remember: Being Financially Independent is an important aspect of your lifestyle and it must not be ignored under any circumstances.

10. Dive into Retirement in style and Enjoy: Following the above steps and using the 50/30/20 rule, shall enable you to achieve your financial and dive into retirement freedom in style.

To achieve your financial freedom, connect with #TeamFinvision today .

Our Contact details: 011-40044366/ 9654341212 Email I’d: info@finvision.in