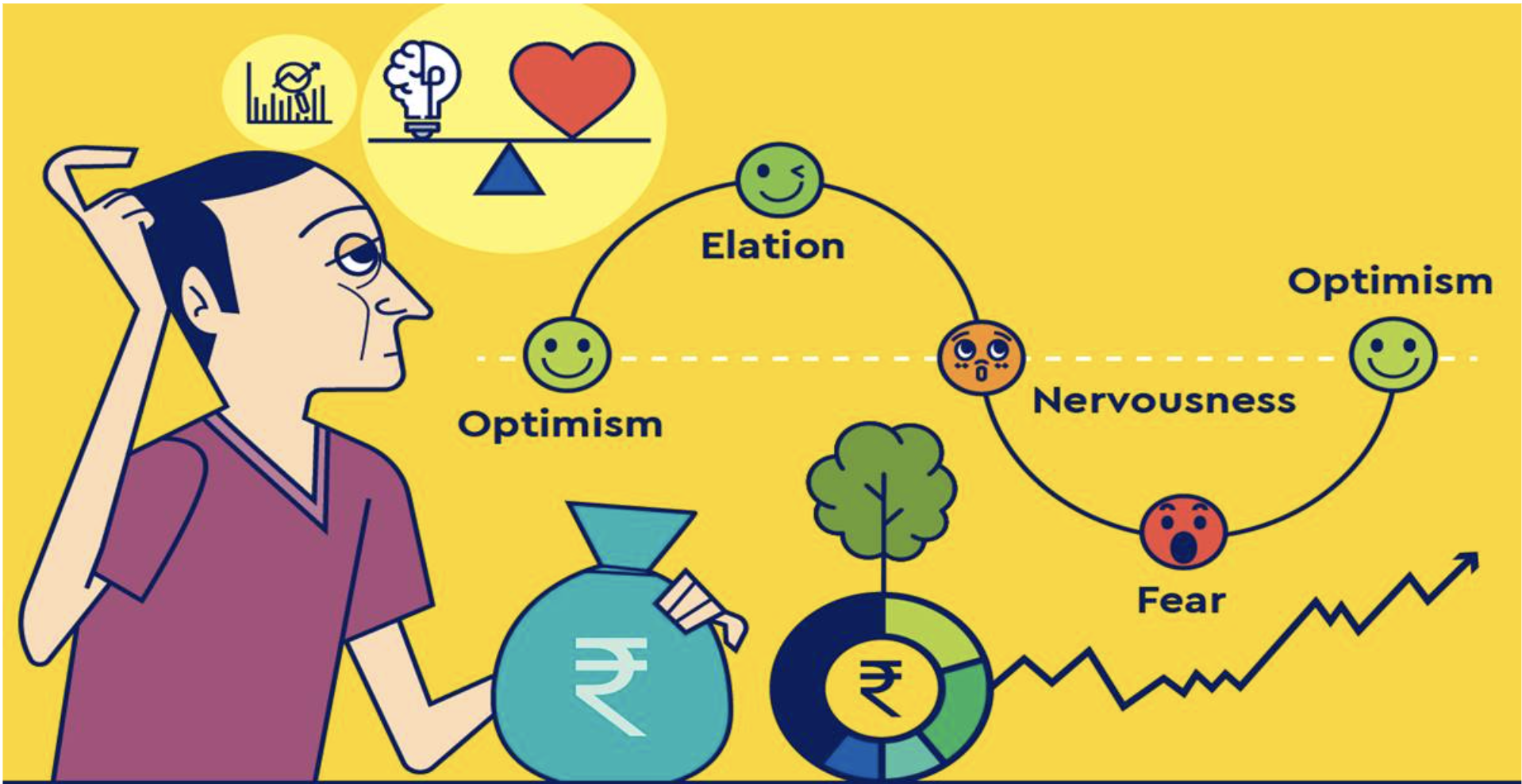

Wealth creation is a long-term game, and its rules aren’t as complicated as they appear. Just like any other area in life, consistency and discipline are at the core of successful investing. Though, most of us do try to approach investments logically, however, what often comes in the way of your perfectly planned investments are the following behavioural biases.:-

1. Anchoring Bias. You may be a victim of anchoring bias if you continue to hold information that could no longer be relevant, and you make financial decisions based on this information. You label any new information you receive as irrelevant to the decision making process. For example, you continue to hold losing stocks with the expectation of the price reaching levels that are no longer viable based on current information. You wait for the right price to sell your stocks even when new data shows the expected price is unattainable. It could impact the performance of your portfolio.

2. Familiarity bias. Familiarity bias occurs when an investor prefers a familiar investment over other feasible possibilities that can also contribute to portfolio diversification. An asset they have previously held and had a favourable experience with can feel less risky, and hence is frequently the “go-to” asset when looking to generate returns. As a result of familiarity bias, portfolio construction and thus investing outcomes can be significantly influenced. It has the potential to cause investors to rule out a wide variety of viable assets. For example, you may invest only in real estate or pick shares of a particular company. It could result in a concentrated portfolio which may not match your risk profile and investment objectives. You may also find your portfolio underperforming as compared to the benchmark over some time.

3. Fear Of Missing Out(FOMO) Investing. We are often triggered when we read or hear about some stock, crypto or other investment gaining in price very quickly. We feel this urgency to invest quickly without diligence. This type of investing is dangerous and may lead to: investing in a fundamentally good product when it is overpriced or investing in something that is primarily a hype and speculation.

Why do we still FOMO invest? As per Nobelist Daniel Kahneman’s ‘people are more affected by the fear of losing (money) as opposed to the joy of gaining’. So, when we see that others may be making money and we are not, we start feeling that we are missing out i.e. losing.

4. Illusion of control. The term Illusion of Control was coined by psychologist Ellen Langer after identifying how people often tend to overestimate their ability to control events. A good part of this is due to the fact that we often tend to confuse between skill and chance events and start seeing connections where there aren’t any. For example, in investing, we may be picking stocks without proper diligence during a bull run and attribute the increase in value to our ‘skill’. Leading us to overestimate our abilities and give us an ‘illusion of control over the value change of our chosen stocks. But, this rise in value is likely to have occurred with a majority of stocks anyway and has nothing to do with our skills. Overconfidence in our skills or sense of control over the outcome of our investments may lead to losses when the circumstances aren’t conducive.

5. Risk aversion: Risk aversion is the avoidance of risks or the chance of loss; this is reflected in their financial choices. Risk-averse investors will favour less risky options, such as fixed income over equity, large-cap over mid-cap, and so on. Nobody wants to lose money, but risk aversion might cause you to lose more money on earnings or make less money than you expected to make. Risk aversion can be avoided by avoiding becoming overly emotionally involved in your investments. Investing carries risks, many of which are beyond your control, and you cannot be correct all of the time.

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave“ -Morgan Housel

To know more:

Register for our next Financial and Retirement planning webinar on 26 June 2022(Sunday): https://forms.gle/5brLgrjUoPC9e82r9

Join our social media initiative: https://t.me/RMiB6j1HPec1ZjVl

Contact us at info@www.finvision.in or call at +91-7508055826 / 9654341212