Choose a mutual fund based on research that has delivered decent risk-adjusted returns over the long term and has an experienced and stable fund management team.

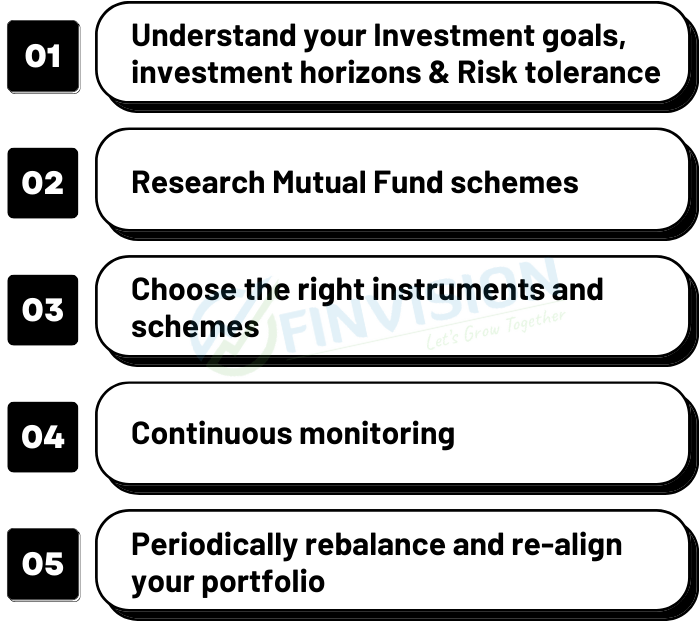

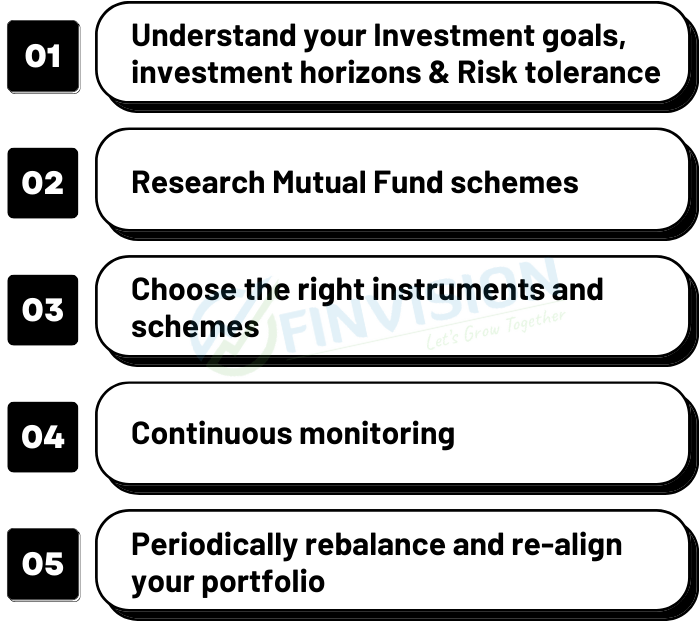

Here are a few steps that can help you succeed in your investment objective:

1. Understand your investment goals, investment horizon & risk tolerance: This must be the first step in the process of investing. Before you invest in mutual funds, you should clearly define your investment goals, investment horizon, risk tolerance, and risk appetite level. Knowing these will help you determine how much to invest, how long to invest, and what type of instruments to select. Based on the investment horizon goals can be categorised into: –

(i) Short-term goals (due in 03 years),

(ii) Medium-term goals (due in 3-5 years),

(iii) Long-term goals (due after 5 years)

Further, you shall prioritise your goals based on their importance. Goals like paying for a child’s education may be more important than purchasing a luxury car. Your capacity and willingness to accept portfolio volatility/ losses represent your level of risk tolerance. If you have a higher risk tolerance, you are typically willing to accept more risk in exchange for the possibility of greater returns.

2. Research Mutual Fund schemes: You can maximise your chances of achieving a profitable investment experience by conducting thorough research on mutual funds that align with your investment goals and risk tolerance. Make sure to read the complete prospectus of the mutual fund scheme, which contains detailed information about the fund’s investment objectives, strategies, risks, and fees. Consider diversifying the portfolio across various asset classes, such as stocks, bonds, REITs, Gold, foreign equity, and other financial assets.

“Right asset allocation is the key to investment returns”

3. Choose the right instruments and schemes: One good way to select is on risk-adjusted returns, an experienced and stable fund management team. There are many different types of mutual funds to choose from, including equity funds, debt funds, index funds, ETFs, and international funds. The funds you choose should be based on your specific objectives, investment horizon, and risk tolerance. For example, if you have an important goal that is due in two years, you must choose a mutual fund from the debt fund category, even if you have a high-risk profile. The time horizon of the goal, its importance, your risk profile, and risk tolerance all play a role in scheme selection.

4. Continuous monitoring: Markets and investments are dynamic and ever-evolving, hence, must keep track of your investments to ensure they remain in line with your investment objectives including the changes in goals over the period, if any. Periodically review the fund performance associated with each investment and analse the performance factoring in the market conditions, stock, and sector allocation by the fund manager. Compare the fund’s performance with the respective benchmark and its performance over different market cycles before deciding on any action.

5. Periodically rebalance and re-align your portfolio: The performance of your mutual fund investments may change over time, resulting in an unbalanced portfolio. Rebalancing your portfolio periodically and re-aligning it to developing investment environment and evolving market dynamics can help ensure that you are positioned for optimised growth and retain an appropriate level of diversification and balance. Doing this regularly can help you maintain your desired asset allocation while also optimising risk and returns. This entails buying and selling mutual funds to realign your portfolio with your investment objectives and risk tolerance.

To illustrate: Consider a scenario where you invested in equity mutual funds seven years ago for a goal that is due in the next 2 to 3 years. In this case, it is prudent to gradually shift your investment from equity funds to debt or liquid funds while keeping market conditions in mind. This shall ensure that any sudden volatility in the equity market does not reduce the value of your investment for your goal and that your needs are met as planned.

‘Remember to factor in the transmission losses and tax implications before any rebalance/ re-alignment.’

Key Takeaway: An intelligent and research-based scientific approach to mutual fund investments is the way to build wealth over the long term. But do remember that investing always carries risks, and hence advisable to consult with a financial advisor before making any investment decisions.

Attend FINVISION year end webinar to dive into the New Year with a worry-free financial lifestyle.

Limited seats, Register NOW👉 https://bit.ly/FinvisionWebinarDec

Reach out to us today at +91-9654341212 or at Email Id: info@finvision.in to schedule a financial consultation. Wherein, we will show you how we can help you navigate market volatility and unlock your full financial potential.

A 15-minute consultation is FREE for the Armed Forces officers’ fraternity.