In the month of March 2020, Covid-19 induced lows in the markets. Since then, we have been advising everybody to realign their investments as per the ‘New Normal’ post Covid. As a result, our investors’ returns have been multifold of the planned 10-15% annual returns (CAGR). Here is the performance of major asset classes, and proactively managed FINVISION Mutual Fund portfolios.

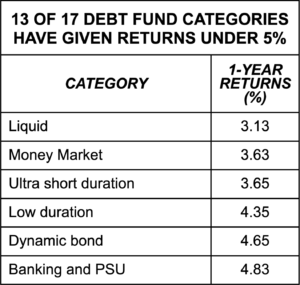

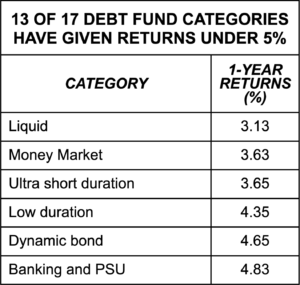

1. Debt Funds: The traditional, made and served for comfort investment strategies of putting the entire investible corpus into debt and thereafter initiating small amounts of STP (Systematic Transfer Plan) into the equity funds have not only yielded dismal returns (less than FDs) but also resulted in additional tax liabilities. The chances of debt fund returns improving in near future too are fairly bleak for the following reasons:-

- a) Interest rates are at historical low levels and likely to rise from here on.

- b) Inflation pacing, and excess liquidity in the market. Post- Covid, RBI reduced the interest rates by 1.75% and may now act to reverse the same to absorb the excess liquidity.

We have been bearish on debt funds space since the RBI bi-monthly meet of August 2020.

Existing Debt fund returns carry an inverse relation to Bond yields/ Interest rates

(1% increase in interest rates may bring down the NAVs of debt funds by upto 8)

2. Equity & Equity MFs: Equity market and equity MF returns for the same period have been phenomenal.

- a) Maximum gains came from the small/ mid-caps and the cyclicals.

- b) Sectors that were outperforming in the pre-Covid era like the financials have generally been lagging post- Covid. The same was repeatedly advised by us in all our communications since the Covid outbreak.

- c) The investors who evolved their strategies to the developing investment environment and dared to invest lump-sum in the equity market, made more gains than the traditional methods of SIP/ STP from debt funds.

“There is nothing permanent but change”

3. Changing Trends: The revival in the Indian economy is for real and the same should continue to drive the markets. However, the basic texture of the market seems to be now changing and is currently experiencing wild swings/ corrections in specific stocks. Market’s form & format from hereon may change, due to:

- a) In March 2020, as lockdown froze all expenditure avenues, households diverted the money set aside for discretionary expenses into the market. Thus increasing retail participation and fuelling a rally in equities.

- b) With the opening of the economy, businesses are taking out working capital invested in the market, and investors too have started exploring spendings on vacations, shopping, revenge buying and so on.

- c) SEBI and RBI clearly conveyed their concerns on the rapid rises in market valuations and are also taking steps to tighten the trading leverages and imposing new margin rules.

- d) The small caps to market index ratio is now at elevated levels hence a need to exercise caution.

Long-term investment is not invest and forget, it requires monitoring and periodic realignment

4. Action Points: Since the beginning of August 2021, we at FINVISION have been continuously booking long term gains and realigning our portfolios to above developments, and changing trends. To be specific, in a very gradual manner we have broadly moved out of small cap mutual funds. Our advice:

- a) Review your investment style, methodology and holdings.

- b) Re-assess and rebalance your asset allocation and components within the chosen asset classes.

- c) Be cautious of your holdings, specifically the small & mid cap equity and debt funds.

* Debt Funds are safe and less volatile is the biggest misnomer that investors carry