For many investors, fixed deposits (FDs) offered by banks have been a traditional low-risk investment option. However, with the growth of the mutual fund industry, debt mutual funds have become a popular alternative for those seeking stable and reliable returns. Let’s compare the two options to understand why debt mutual funds may be a better choice for the low-risk investors.

Fixed Deposits (FDs)

Fixed deposits are a type of investment in which an investor deposits a lump sum of money for a fixed term, typically ranging from one year to ten years. In return, the bank pays a fixed rate of interest for the term of the deposit.

One of the main benefits of fixed deposits is the stability they offer. The interest rate is guaranteed for the term of the deposit, providing investors with a predictable return. Additionally, FDs are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC), providing insurance coverage of up to ₹5 Lakhs per depositor per bank in the event of bank failure.

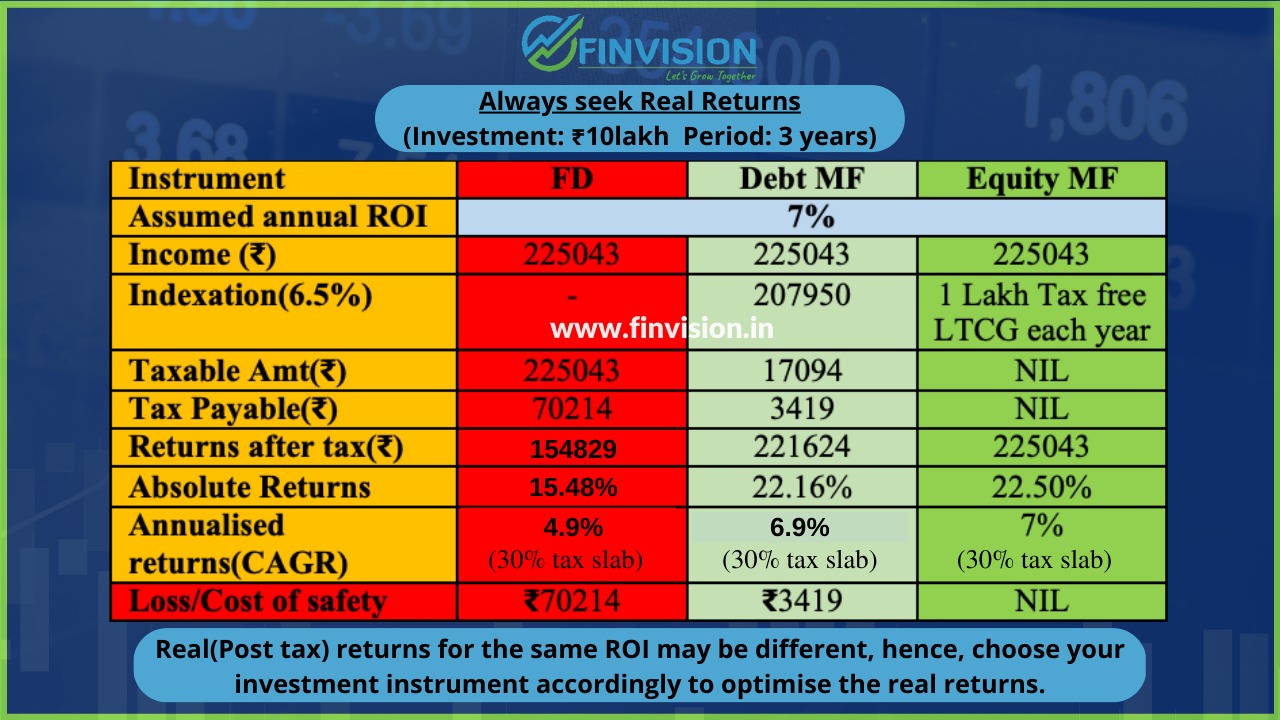

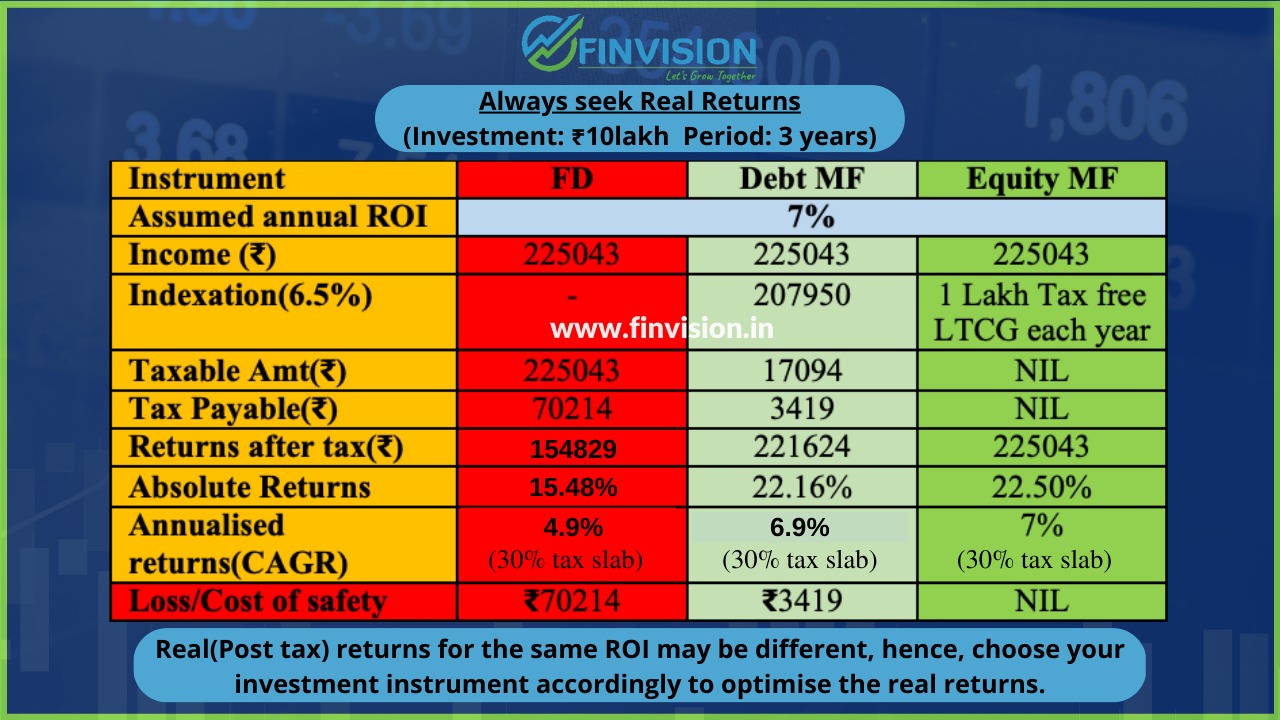

However, the stability of fixed deposits comes at a cost. The interest rate offered on FDs is typically lower than other investment options, and the returns are taxed as per the investor’s income tax slab.

Debt Mutual Funds

Debt mutual funds invest in fixed-income securities such as government bonds, corporate bonds, and commercial paper. They are considered low-risk investments and offer a good option for those seeking stability in their portfolios.

Advantages of debt mutual funds:

1. Potential for higher returns compared to fixed deposits.

2. Greater tax efficiency: Long-term Capital gains from debt mutual funds are taxed at 20% with indexation, which can significantly reduce the tax liability compared to fixed deposits, where the interest earned is taxed as per the investor’s income tax slab.

3. Flexibility: Unlike fixed deposits, which have a fixed term, debt mutual funds can be redeemed at any time, providing investors with access to their money in an emergency.

Indexation benefit from Debt funds

1. Debt mutual funds and fixed deposits both have their advantages and disadvantages, but for low-risk investors, and specifically in the current market scenario of interest rates and bond yields giving early peaking out signs, debt mutual funds may be a better option.

2. When deciding between the two options, consider your investment goals, risk tolerance, and financial situation. Opt for the debt funds only if you are willing to accept a slightly higher level of risk for the potential of higher returns and greater tax efficiency.

3. Regardless of whichever option you choose, it is important to diversify your investments and not put all your eggs in one basket. That will help to minimise your risk and maximise your returns over the long term.

For any help and smart financial and investment needs #TeamFinvision at +91-7508055826/ 9654341212.

Found the blog useful! Don’t forget to share it with friends, subscribe to our newsletter, follow us on LinkedIn: https://www.linkedin.com/company/80388138/admin/

Join our Telegram channels: https://t.me/+-trZbgtThPw2Y2E1 to stay updated..

Finvision YouTube: https://www.youtube.com/channel/UCW-avyIZvPg2meoXk3X4nQA

Link to Register for the February month Finvision Financial and Retirement Planning Webinar(26th February): https://forms.gle/1yozQGYVV1JYANr87