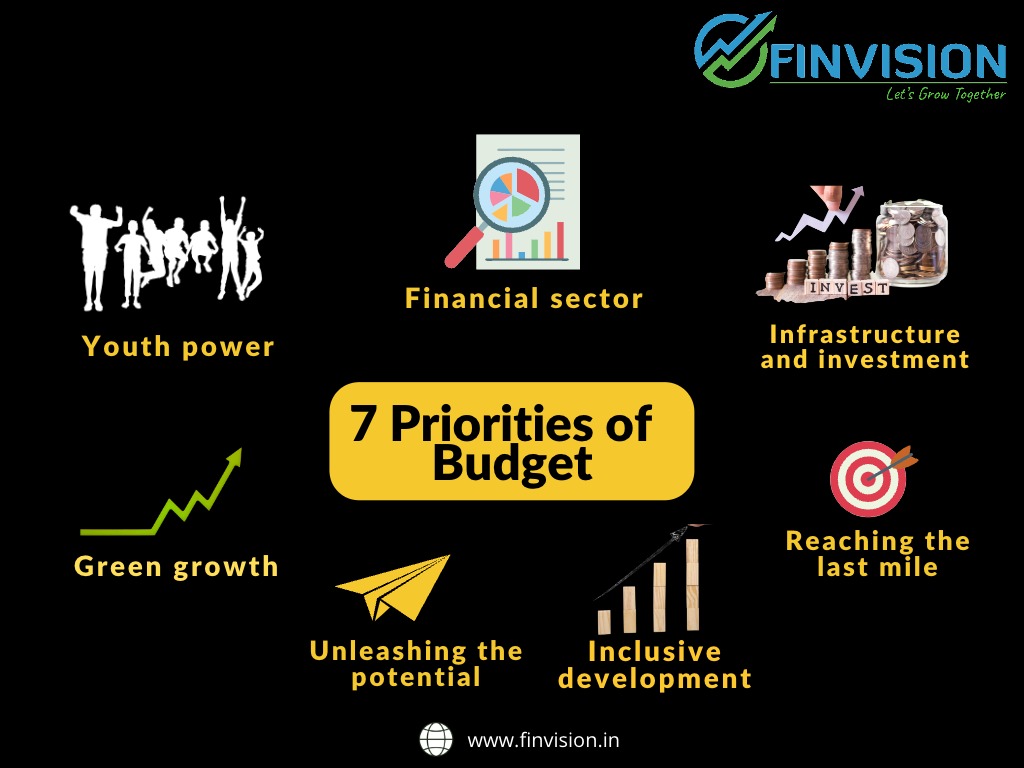

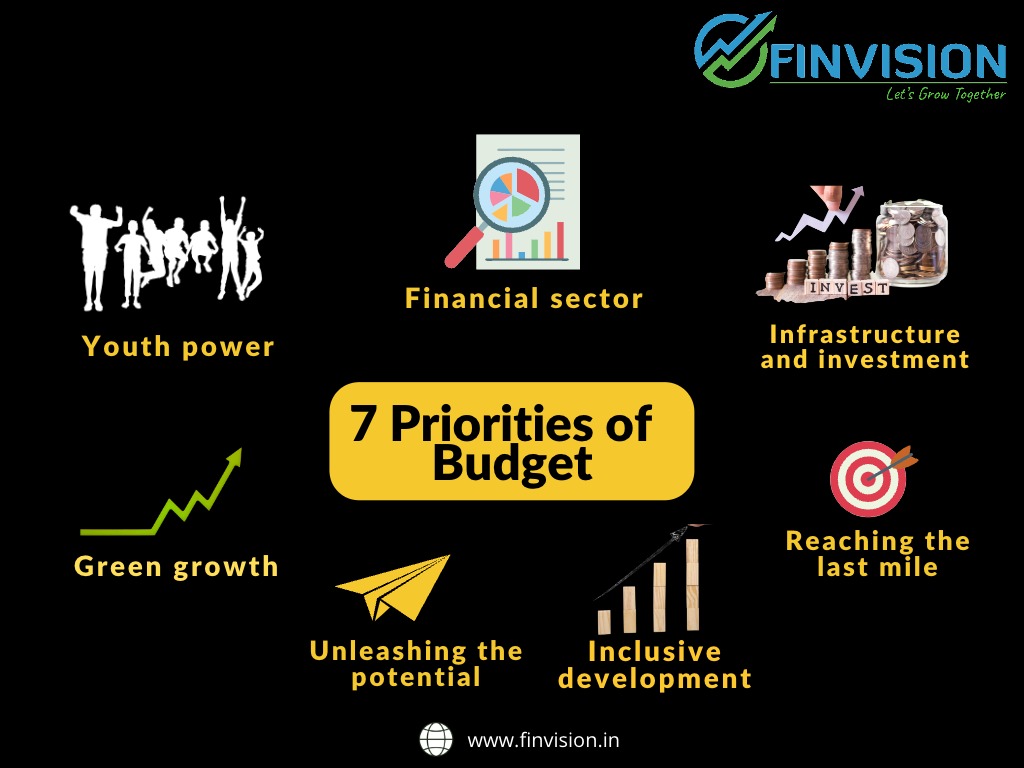

Aims that the Govt attempts to achieve through this Budget are:

1. Facilitate ample opportunities for citizens, especially youth.

2. Provide strong impetus to growth and job creation.

3. Strengthening of macro-economic stability.

4. Women empowerment and enable women self-help groups to reach next stage of economic empowerment.

5. Help self-help groups with raw material supply, branding, marketing of products.

Important matters related to Personal Finance

Taxation

1. Highest tax rate reduced from 42.7% to 39% .

2. NO personal income tax limit increased from existing ₹5 Lakhs to ₹7 Lakhs.

3. Maturity proceeds from insurance policies with annual premiums more than ₹5 lakhs will now be taxed, except in case of death (applicable for policies purchased after 31 March 2023).

4. Leave encashment exemption (private sector) increased from ₹3 Lakhs to ₹25 Lakhs.

5. Payment received by Agniveers will be tax exempted.

6. New tax regime will now be the default tax regime and tax rebate limit extended to ₹7 Lakhs. The old tax regime shall also continue with the tax slabs are under:

₹0-3 lakh: NIL

₹3-6 lakhs: 5%

₹6-9 lakhs: 10%

₹9-12 lakhs: 15%

₹12-15 lakhs: 20%

Over ₹15 lakhs: 30%

Savings and Investments

1. Senior Citizens Savings Schemes investments limit hiked from ₹15 Lakhs to ₹30 Lakhs.

2. Monthly Income Scheme maximum limit increased from ₹4.5 Lakh to ₹9 Lakhs and ₹ 15 Lakh for joint accounts.

3. One time ‘Mahila Samman Bachat Patra’, a new deposit scheme for women with a tenure of 2 years with tax rebate up to ₹2 Lakh of investment and 7.5% return.

4. Market Linked Debentures (MLDs) to lose the tax advantage & will now be taxed as bonds and no more as equity.

Aspects concerning Market Investments

1. Fiscal deficit to be at low of 5.9% in FY 24 from 6.4% in FY 23. As a result, 10 year bond yields moved from 7.343% to 7.277% (drop of 0.90%).

2. Capital expenditure increased by 33% to ₹10 Trillion.

3. Savings from taxation for the individual tax payers would lead to increased consumption and spendings.

Takeaways and action for Investors

1. Equity; Align your allocations towards mutual fund schemes investing into infrastructure, banking, manufacturing and consumption related sectors.

2. Debt: Environment for fixed income is decidedly getting more constructive given the better macro stability. Bond yields movement indicates that the RBI may soon take a pause on hiking of interest rates. Hence, debt mutual fund schemes may now become attractive, however, be very selective.

3. After almost 16 months of zero gains in equity as well as debt, from here on, both may do well.

Do plan your Income tax, savings and also align your investments accordingly.

Need help, contact #TeamFinvision at 011-40044366/ 9654341212/ 7508055826.

Happy Investing!