Answer. One of the features of an SIP(Systematic Investment Plan) is that it inculcates a discipline of regularly investing irrespective of the market levels. This helps investors in refraining from timing the market and averaging out the cost of the mutual fund units they purchase over the long term. So even if an investor purchases units at a high price through an SIP, they would have also bought these units at lower levels at some time in their investing journey, eventually leading to costs averaging out in the long run.

Question-2. Can I not re-enter the market at lower levels again?

Answer. While inflation and interest rate action in India and the rest of the world will determine the direction of the market, one can still not take a definite and absolutely certain call on where the markets are headed. Also, it is impossible and futile to attempt catching the bottom of market and perfectly time the stop/ restart of SIPs.

Question-3. With talks of a recession globally, what could returns on investment look like?

Answer. According to the IMF, India’s growth was the highest among major economies in 2021, is likely to be the highest in 2022 and could also be the highest in 2023 too. Therefore, though the markets can be volatile in the short-term, our fundamentals are in place for the growth in the long term. Hence, take a call accordingly.

Learnings that you can take from the common SIP mistakes:

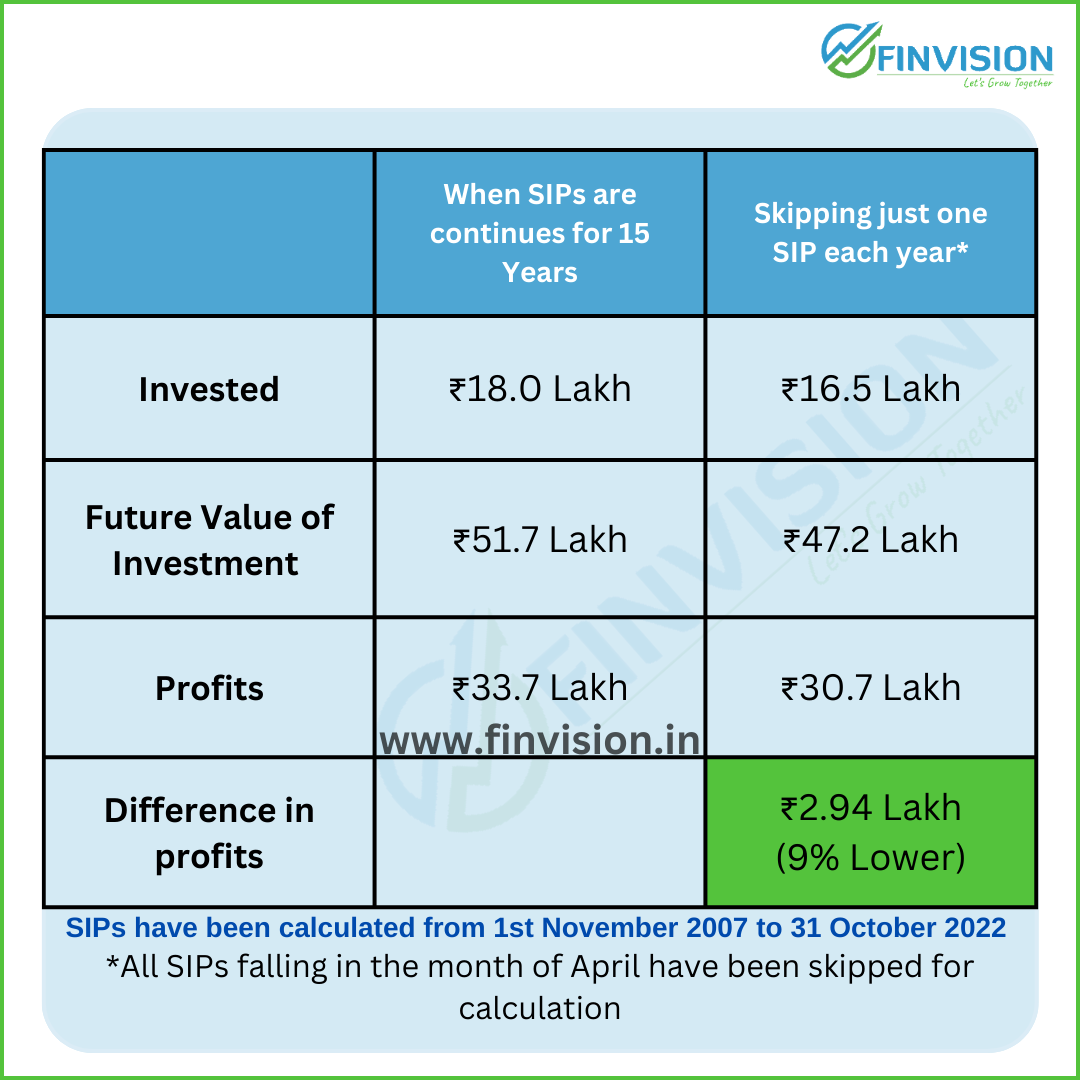

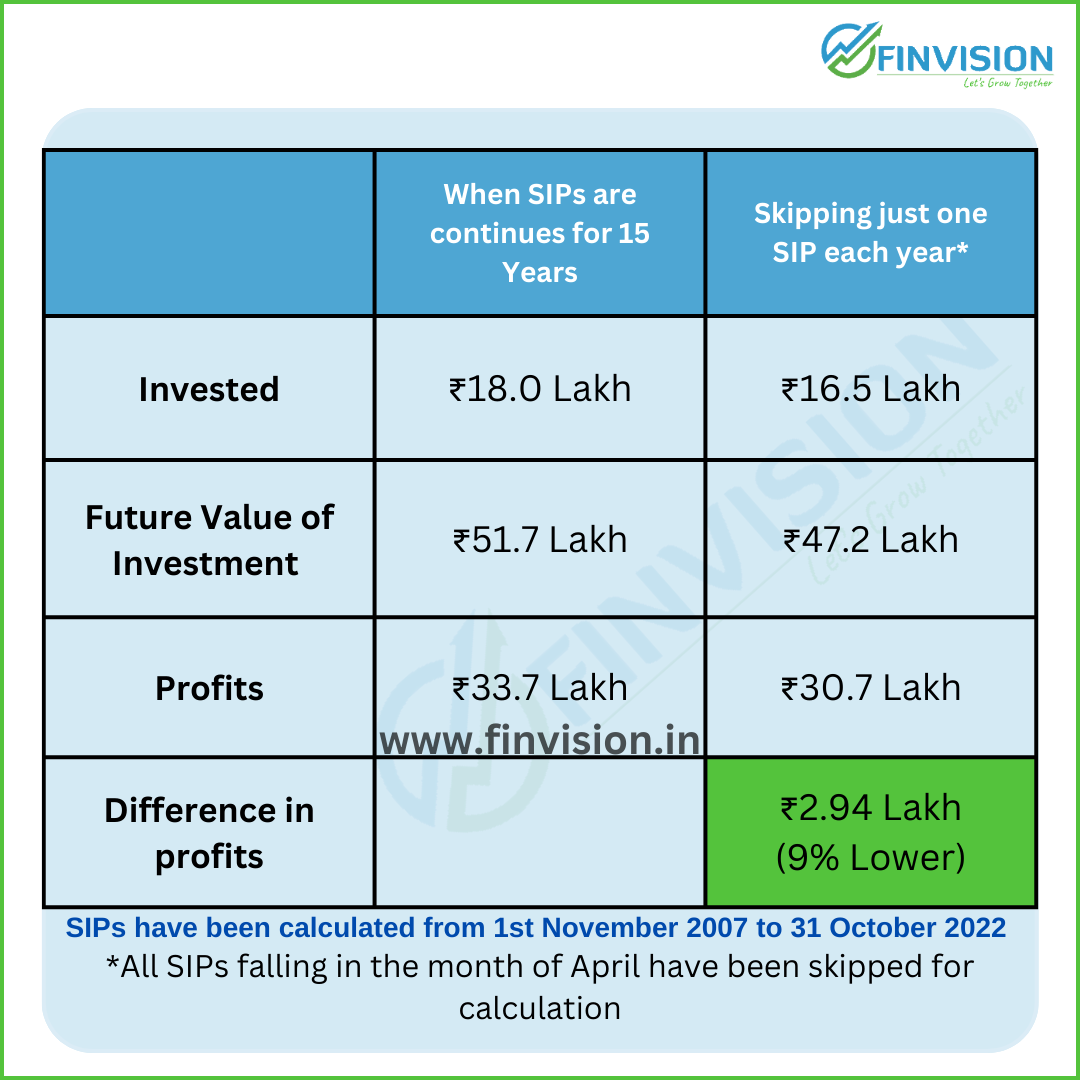

Mistake-1: Skipping of few SIPs. Skipping just one SIP every year can reduce your returns by nearly 9%. Say, you are doing a monthly SIP of ₹10,000 for 15 years. Now, skipping a few SIPs in 15 years may not look like a big deal. However this is how your corpus will suffer.

(a) Growth: In these schemes returns continue to get reinvested.

(b) IDCW(Dividend): Returns are distributed in form of dividends at periodic intervals.

In IDCW schemes, returns are distributed, which only breaks the compounding but also leads to higher taxations.

Mistake-4: Not having a goal attached to SIPs. Market data indicates that >43% retail investors don’t hold equity assets for more than 2 years. Primary reason for the same is: not having a goal attached to their SIPs .

Mistake-5: Not reviewing and re-aligning SIP investments. ‘Buy and forget strategy’ seldom works, Therefore, periodic and at least an yearly review of your investments is a must.

For personalised investment solutions, please contact #TeamFinvision at +91-7508055826/ 9654341212.