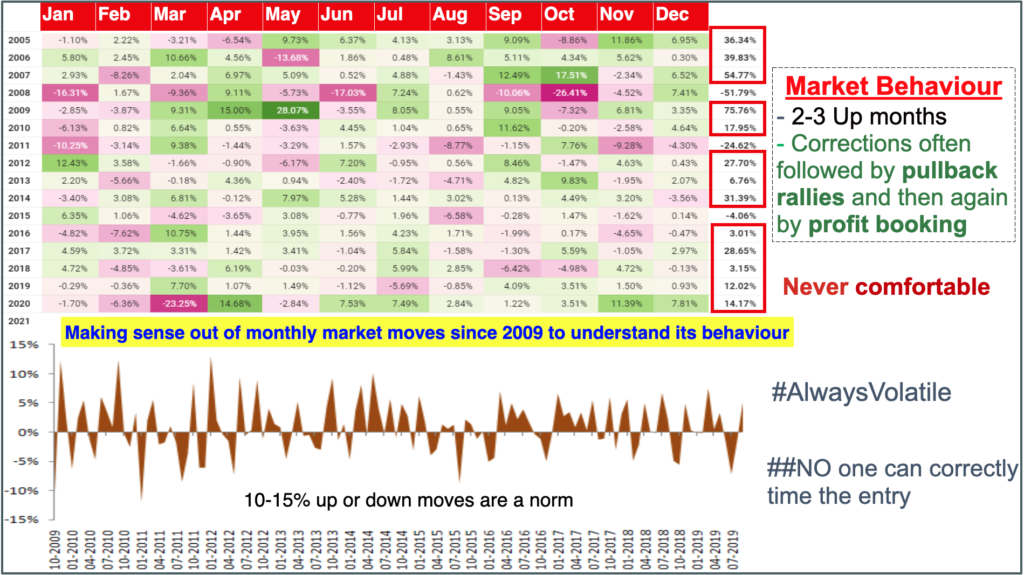

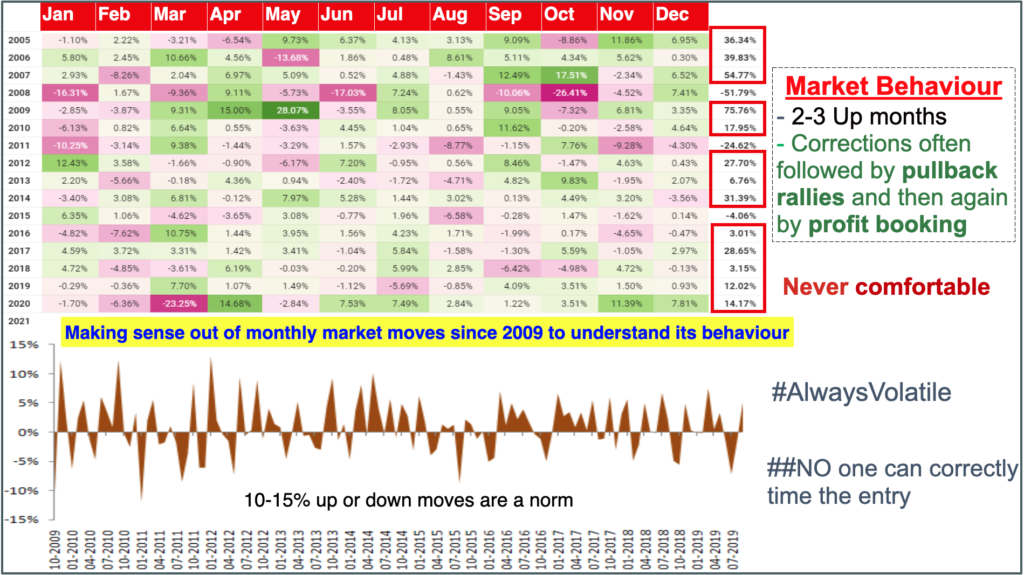

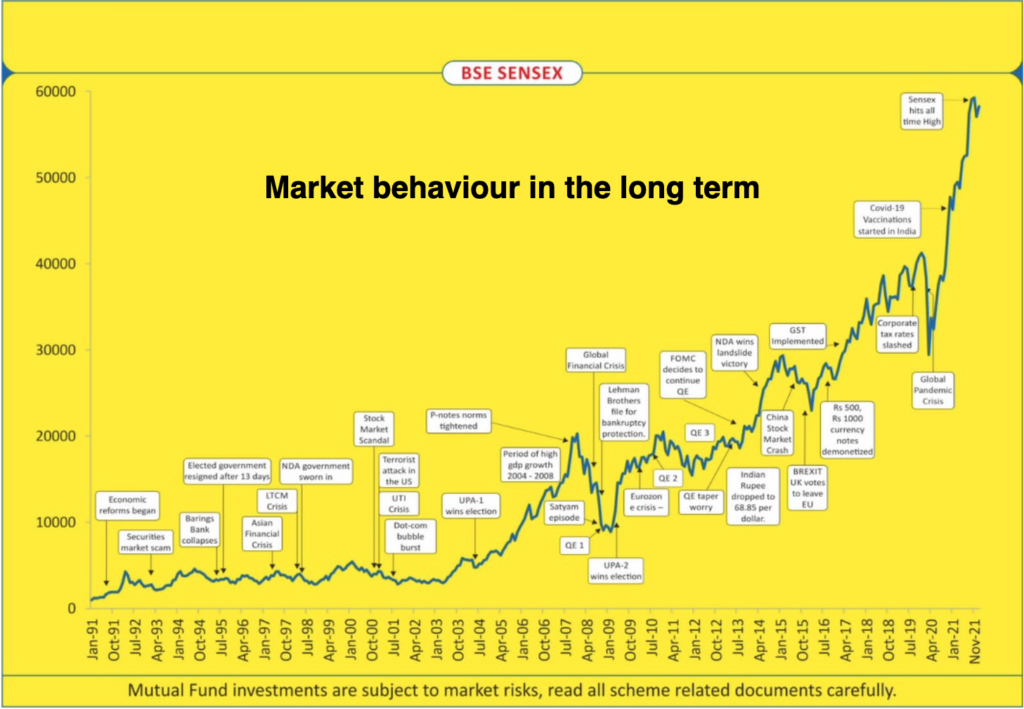

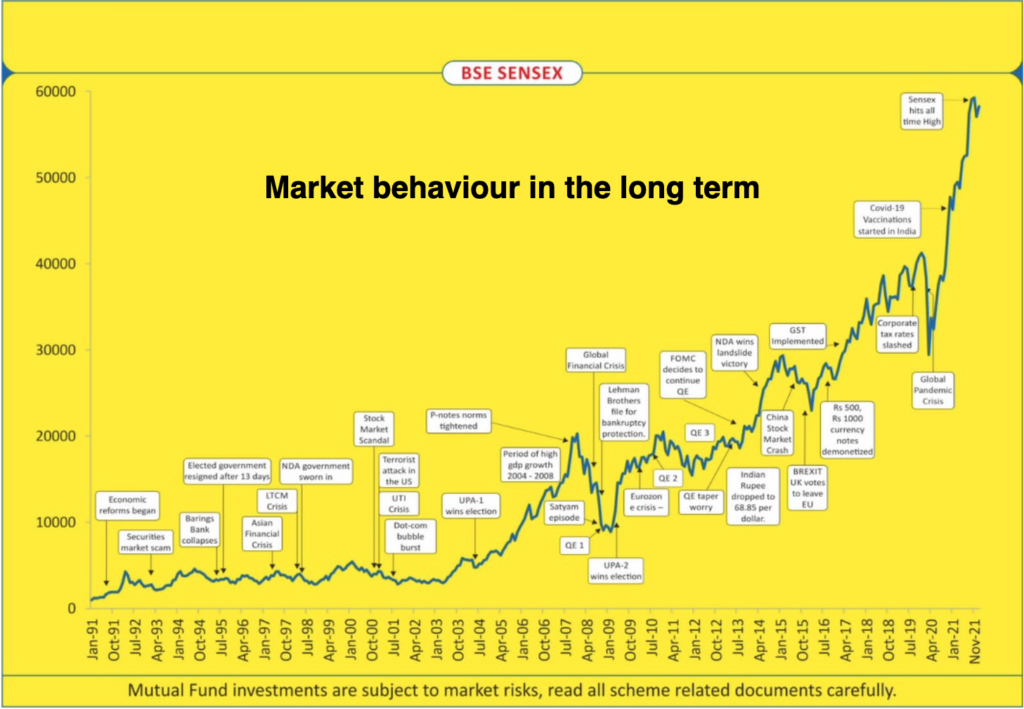

The equity market has been volatile over the past 6-8 weeks. SENSEX from a high of 62,245 on 19 Oct 2021, corrected by more than 7000 points (11.3%) to 55,133 on 20 Dec 21. This increased volatility would have been stressful, especially for new investors. Let’s be informed and attempt to understand what is going on and why it is happening, so as to be better prepared to deal with the risks and capitalise on opportunities.

Reasons for increased volatility in the market:

- Rising Covid cases and fears thereof due to the new variant, Omicron.

- High commodities prices and overall inflation which was so far thought to be transitory seems to be persistent and for real.

- Central banks including the RBI are still keeping interest rates low, however, the market fears that persistently high inflation may force the central banks’ to increase the rates.

- How the US tapering of bond purchase programs will play out. Though the market is prepared for a gradual and orderly taper by the Fed but not for too early or an abrupt cut.

- Given these high valuations and a phenomenal one way rally since March 2020, a 10-15% correction is normal.

- The Indian market has outperformed all others and of late Foreign Investors (FIIs) have been profit booking.

What should we as investors expect? Understand that the market hates uncertainty and historically has always exhibited increased volatility in all phases of uncertainties.

Short term outlook: In the short term, the market will try to assess the economic impact of another Covid wave and US bond taper and will keep reacting to information as it comes. *Note: that Covid waves 1 & 2 affected India with a lag of 1.5-2 months over the US, UK and other nations.

Long term outlook remains positive. The Indian economy is majorly domestic demand driven and is showing clear signs of recovery with GDP expected to be at double digit growth rate. The earnings outlook is also positive. Recent festive season sales were very encouraging. The ongoing correction coupled with a turn in the economic cycle should provide a good platform for Indian equities to rise. Thus investors need not read too much into these short term market movements as risk aversion is at play. Be patient and do not make hasty decisions.

What should Investors do?

- Do not panic: Though nobody likes to see red in portfolios, but understand that equity, as an asset class by nature, is volatile. Historically, a 10-15% correction even in strong bull markets has been a norm and should be taken as an opportunity to invest more.

- Do not give into herd instincts: Herd mentality is typical in behavioural finance wherein we feel comfortable following what our colleagues, friends and relatives are doing. But just because many of your acquaintances have done something, it may not be the right thing to do and may cause a lot of harm to your financial interest. Being patient in uncertain and volatile markets is the best investment virtue.

- Stick to your financial plan: The move up or down market moves, do not change your financial goals. Hence, be disciplined and keep investing for your long term goals irrespective of market movements.

- Focus on your asset allocation: As advised earlier, asset allocation, continuous monitoring and realignment/ rebalancing on a regular/ periodic basis is important to control risks and shall always be the key to achieve best risk adjusted returns.

Always engage with a good and proactive financial advisor: In good times and bull markets everything seems hunky dory. But you will need some hand-holding in uncertain situations and a good and proactive financial advisor may help you remain disciplined and better informed in volatile markets. At the same time, don’t expect financial advisors to have answers to all your questions and keep crystal gazing at all the market moves.