Complete your Tax saving investments for the Financial Year

Did you know? The deadline for tax-saving investments for the current Financial year is 31 Mar 2022. If you do not complete your tax-saving investments before the deadline, your tax liability for FY 2021-22 will be higher.

To save taxes under sec 80C and generate wealth ELSS is a good option.

What is an ELSS? An ELSS fund or an equity-linked savings scheme is the only kind of mutual funds eligible for tax deductions under the provisions of Section 80C of the Income Tax Act, 1961. You can claim a rebate of up to Rs 1,50,000 and save upto Rs 46,800 in a year in taxes by investing in ELSS mutual funds.

Why are ELSS funds a good investment option? They offer:

1. High return potential

2. Lowest lock-in period of 3 years

3. Save up to Rs 46,800 on taxes

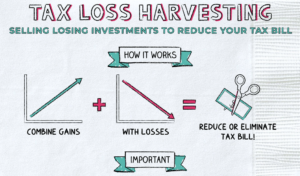

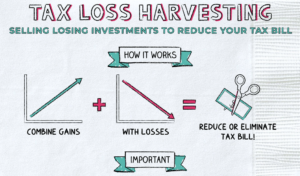

Make use of the Tax Harvesting to reduce tax liability

Make the most of tax-loss harvesting to reduce your tax liability.

What is Tax harvesting? An act of booking unrealised losses to effectively reduce the realised gains and, hence, reducing the tax payable.

What Should you do? If you have realised capital gains on which you need to pay taxes, you can reduce your tax outgo by selling any holdings that are in losses before 31 March. At present, short-term capital gains tax is levied at 15 per cent on stocks sold before 1 year of investments.

Though booking a loss is painful because we are all loss averse & we instinctively try to avoid losses. However, booking of some losses now will benefit you for the following:-

1. Reduce your STCG & hence taxes.

2. This reduction in taxes can add up in the long run and lead to better portfolio returns.

3. Get rid of duds in your portfolio.

For more details please feel free to contact us at 011-40044366/ 9654341212.

Link your Aadhaar with your PAN: It is mandatory for your to link Aadhaar with PAN, on or before 31st March 2022. If your PAN is not linked with Aadhaar, the PAN shall become inoperative from 01 April 2022. Once PAN becomes inoperative, it will be deemed that the investor had not furnished, intimated, or quoted his/her PAN and accordingly be liable for consequences under the Income Tax Act.

As a result, all your investments including market instruments like Mutual Funds etc may get restricted and higher TDS may be deducted for the payout transactions. Kindly act now and link your Aadhaar with PAN to avoid any disruptions in transactions or warranting higher TDS deduction.

To check the status of linking your PAN with Aadhaar, please Click here

To link PAN with Aadhaar, please Click here