India stands out as an Oasis in the sandstorm with the economy exhibiting promising signs of a positive turnaround, inflation well managed and a growth rate much better than its peers. Moreover, the Indian financial markets have defied all odds and broke previous records with the Nifty 50 crossing 19500 levels and Sensex 65000. As the nation emerges from a period of challenges, the mid-year is a good time to assess and position your investment portfolio to capitalise on the new opportunities that lie ahead.

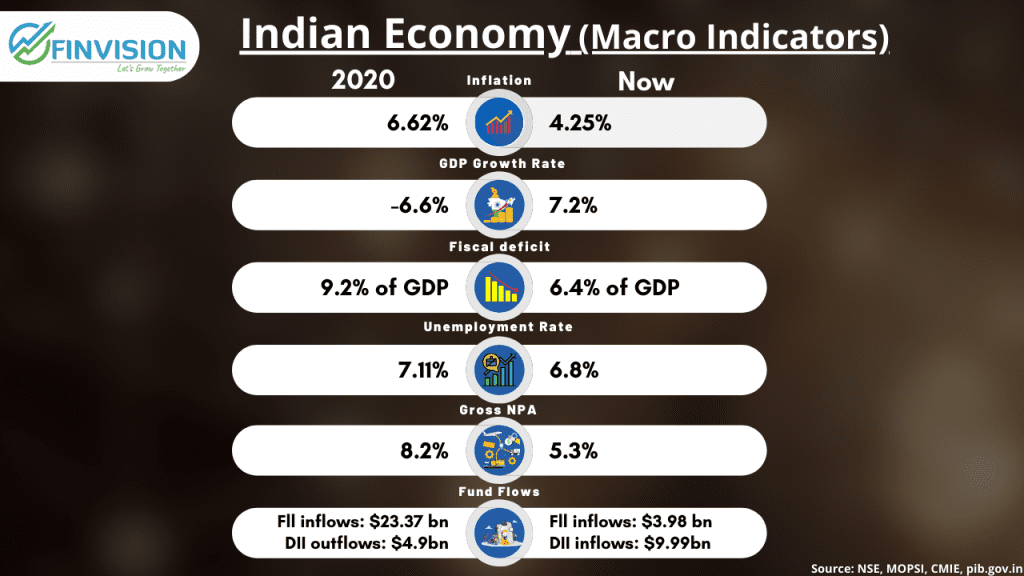

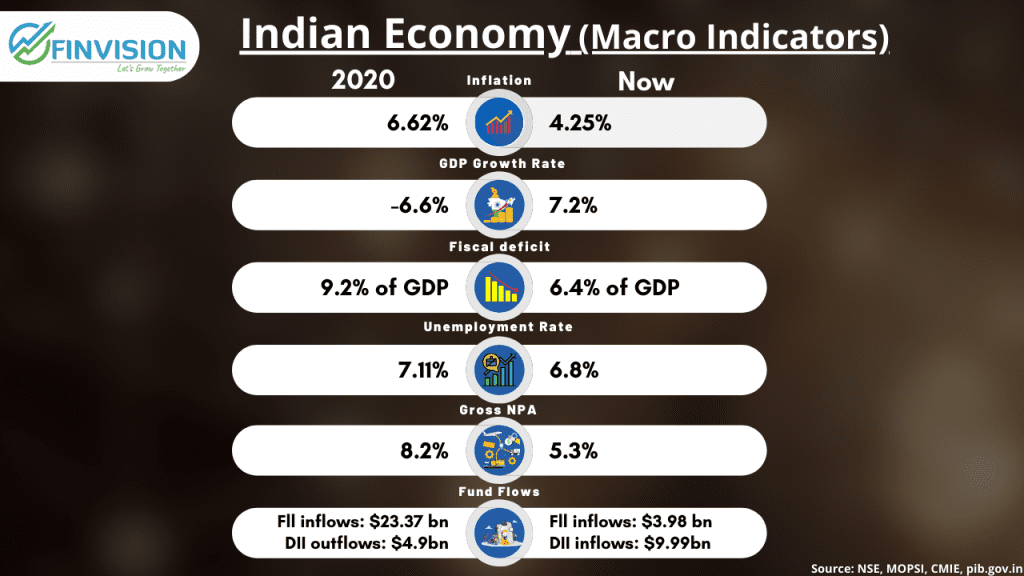

Indian macro data continues to be favorable despite global economic and geopolitical uncertainties:

1. Growth looks promising fueled by a robust corporate balance sheet, favorable policy, and economic environment.

2. S&P assessments indicate an increase of approximately 50% in aggregate EBITDA during FY24.

3. Crude oil prices are settled at the comfort zone of $70-80 per barrel Vs $120+ last year.

4. Good rains all across have receded the fears of El Nino’s impact on monsoons too.

Here’s how you can strengthen your investments and strategically position your portfolio to take advantage of the evolving landscape:

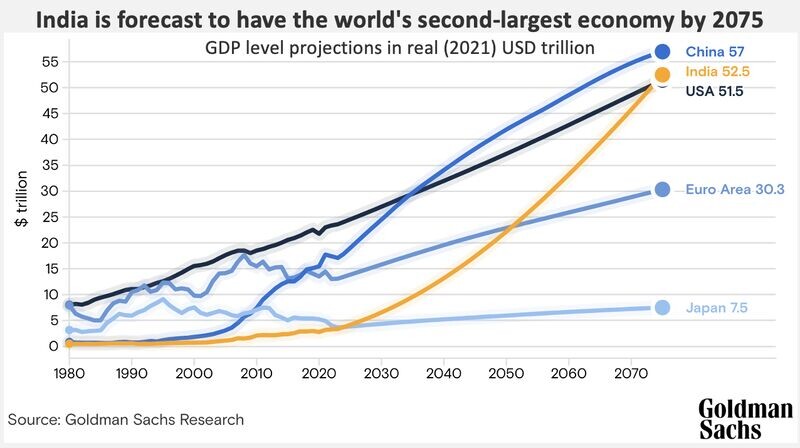

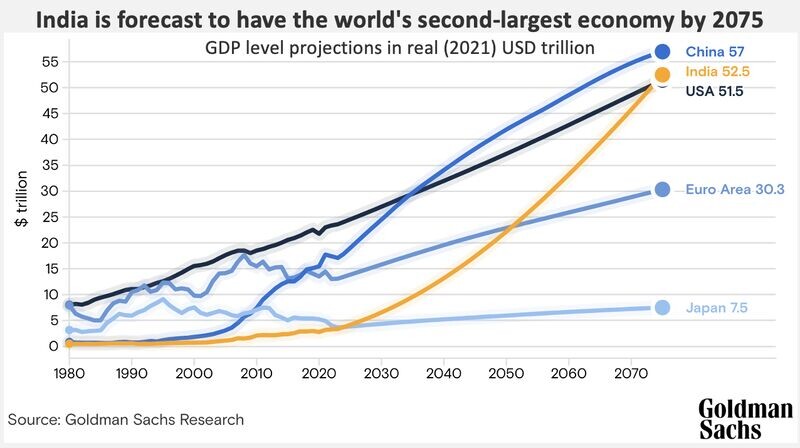

1. Economic Recovery: Post-COVID, India has witnessed a robust recovery. Govt efforts to accelerate vaccination, coupled with policy reforms to stimulate growth, have contributed to a positive turnaround. Key sectors of manufacturing, infrastructure, and services have been exhibiting signs of revival, attracting domestic and foreign investments. India clocked in GDP growth rate of 7.2% in FY 2023. As per S&P India continues to be on top of emerging economies. Exports, credit growth, and real estate revival are some of the other tailwinds of the economy and equity markets.

2. Rising Consumer Demand: Consumer demand is likely to be the key driver of India’s growth trajectory. India has a demographic dividend comprising one of the largest young populations with a median age of 28.2 years according to data from World Population Prospects (WPP). This creates a large workforce that should further continue to drive India’s consumption story. There is a need, therefore, to carefully craft investments to tap into the evolving needs and preferences of the Indian consumer. A hint could be taken from the historical trends that emerged in other developed nations when their GDP crossed $3 Trillion and national per capita income of $2000.

3. Green Initiatives & China+1 Strategy: Budget commitments towards renewable energy, environmental sustainability and push for clean energy sources to reduce carbon emissions present opportunities in the ESG (Environmental, Social & Governance) or responsible investments.

4. Sector rotation and change in market Cycle: With the fast pace of changes and the economy moving away from the deep shocks of Covid and the high-interest rate regime. The turn in interest rate cycles looks imminent. Globally too, while the post-Covid recovery was led by NASDAQ ie tech/IT heavy index, however, that is not the case now, as the leadership has changed. Wherein, while NASDAQ and tech-based global indices seem to be still struggling, but many emerging markets have taken the lead and even Japan (Nikkei) is moving out of 3-decades of consolidation. Thus the sector rotation is evident.

5. Debt, Gold, and other asset classes: Globally things seem to be stabilising, worries of inflation are veering off and change in the interest rate cycle appears evident. Thus, reassess your debt to align it to benefit from the likely downward move of interest rates. Also, since gold generally works as a hedge against inflation, hence, if inflation cools down, then so should be gold. Some allocation into these two assets for diversification is a must, however, do keep pace with many recent changes in their taxation.

‘Always chose debt for storing wealth and Equity for growth’

6. Basic tenets of simplicity and diversification:

(a) Diversification: Essential for managing risks and capitalise on emerging opportunities. Even within your equity basket, it’s important to diversify the portfolio across market caps, themes, and styles.

(b) Focus on fundamentals: When investing in equities, focus on a portfolio of quality MF schemes and stocks with strong fundamentals, sustainable business models, and potential to benefit from the emerging trends. Take a long-term view of businesses rather than focusing on fads, and short-term media news & noise.

The above shared principles should help you better handle downturns and even if the market does not perform as expected, the portfolio should stand resilient to weather the turbulence. Avoid investing in equity if your horizon is less than five years and don’t choose debt if you are looking for growth. Connect with #TeamFinvision to craft a portfolio with the right asset allocation meant for your specific financial goals, risk appetite, investment horizon, and expectations.

Link to register for the ‘Financial and Retirement Planning: Webinar’ scheduled on 30 July 2023👉 https://forms.gle/jiHGNe3XuW3wyst96

Action Point:

As India enters the अमृत काल, you have an opportunity to position your portfolios strategically for long-term growth. The country’s economic recovery and market resilience provide a favorable environment for investments. By choosing a #Finvision well-diversified and balanced portfolio, focused on quality, you will navigate the evolving economy and potentially benefit from its growth trajectory. Act now to exploit the opportunity in a market rally to strengthen your investments and benefit from India’s growth.

For all your Financial and Retirement planning needs contact #TeamFinvision at +91-7508055826 / 9654341212 or email us at: info@finvision.in