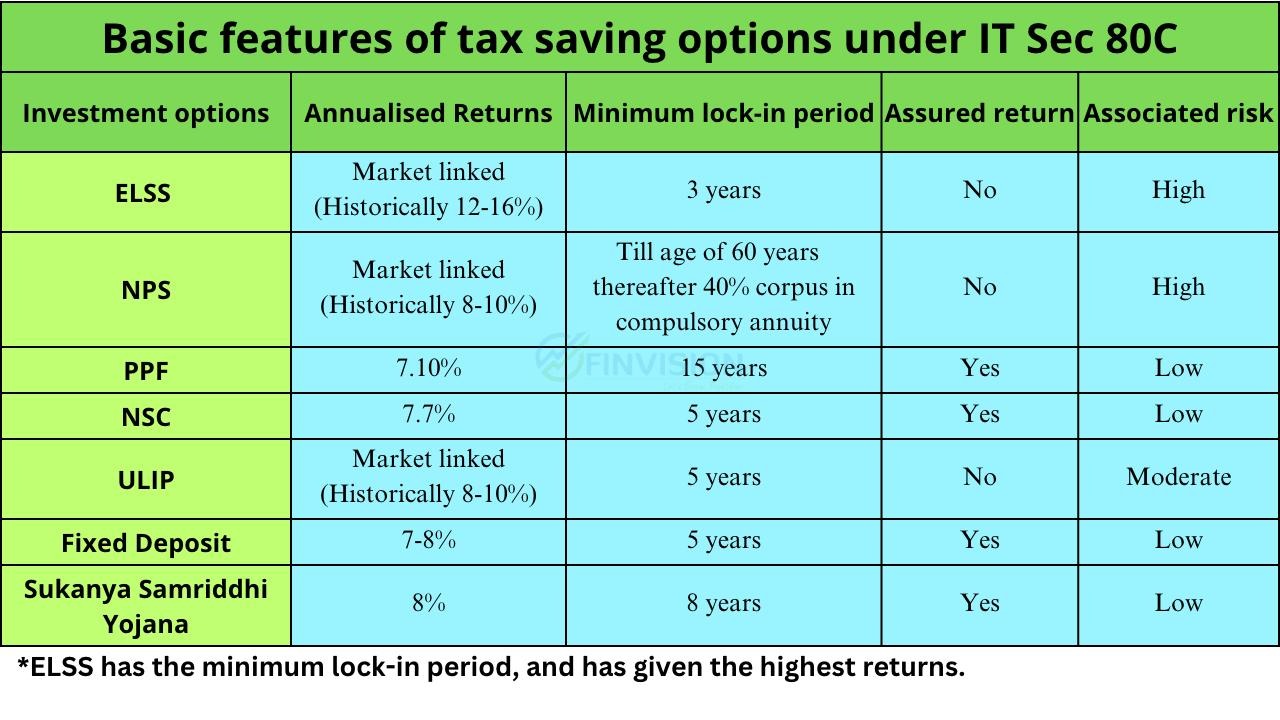

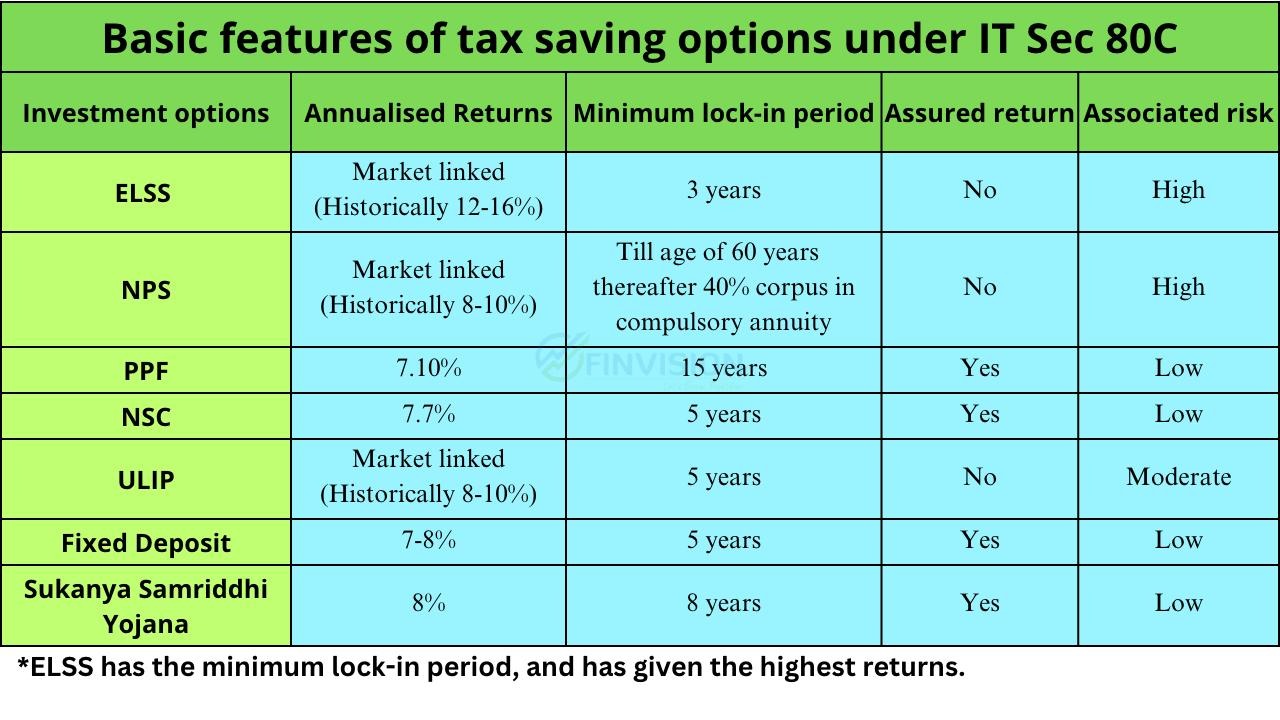

Tax saving options under IT Sec- 80C

All taxpayers as well as HUFs are eligible for Sec-80C deductions. The instruments that qualify under this section are your annual subscription amounts to DSOP, PPF, AGIF, NSC, ULIPs, Tax saving FDs, Sukanya Samriddhi Yojana, Tax saving mutual funds(ELSS), Home Loan principal amount paid, etc.

Do note: Under Sec-80C, the total eligible amount is ₹1.5Lakhs, and this is the cumulative amount of ₹1.5Lakhs amongst all these instruments.

Tax-saving options other than IT Sec-80C

1. Section-80D(Health Insurance Premium): Premiums paid towards health insurance policies for self, spouse, and dependent children of ₹25,000-₹50,000 are eligible for tax deductions. In addition, a deduction of ₹25,000-₹50,000 depending on their age is available for buying health insurance for the parents. Thus, the overall rebate can range from ₹25,000 to ₹1,00,000, depending on the age of your family members. Also, in case you have not taken health insurance you can still claim up to ₹5,000 for incidental health check ups and expenditures.

2. Sec-80CCD(National Pension Scheme): A taxpayer can save tax by investing up to ₹50,000 in NPS tier-I. This is over and above the ₹1.5 lakh limit available under Sec-80C

3. Sec-80U: Individuals in the permanent medical categories with a disability of 40-80% can claim a deduction of up to ₹75,000, for >80% the exemption limit is ₹1,25,000.

4. Home Loan Interest (Sec-24B): You can claim deductions on Interest paid on a home loan. The maximum deduction available is ₹2,00,000 for a self-occupied property. For a let-out property, there is no limit on the amount of deduction.

5. Interest on Education Loan (Sec-80E): Interest paid on an education loan is eligible for tax deductions. There is no annual limit on the amount of deduction, and it is available for up to 8 years.

6. Donations (Sec-80G): Allows taxpayers to save tax by donating money to eligible charitable institutions and organisations. This deduction ranges from 50% to 100% of the amount donated. Do remember to take the PAN number of the organisation to which you have donated.

7. Saving Account Interest: The interest earned up to ₹10,000 from your savings bank account is exempted under Sec-80TTA. For the senior citizens this exemption amount is ₹50000 (on savings account & FD) and applicable IT Sec is 80TTB.

8. House Rent Allowance: Individuals getting HRA as part of salary are allowed tax exemption by a certain amount. The benefit to a limited amount is also available to self employed and salaried class taxpayers not getting HRA as part of salary but paying rent. The details of exemption have been explained through our video: https://youtu.be/8UiKXFay1sQ

Tax saving provisions under Sec-10:

All superannuation and PMR receipts to include leave encashment, Gratuity, Commutation, AGIF benefits, etc are tax exempted under IT Sec-10. Also, these benefits shall continue to remain tax exempted even under the new tax regime.

This year do utilise the above provisions to reduce your tax outgo and smartly plan the tax saving investments for the ongoing year.

Contact #TeamFinvision for smart planning of your tax savings and investments.

Use this link to get your IT Returns filed by Finvision experts: https://www.finvision.in/filing-of-income-tax-returns-2023/

For any help email us at itr@finvision.in and/or connect with us at 9654521212