Established in 1983, it was America’s 16th largest commercial bank. SVB had operations across ten countries, including India.

What was SVB’s core business?

It provided banking services to nearly half of all US venture-backed technology and life science companies. As the preferred bank for the tech and startup sector, SVB’s services were in hot demand throughout the pandemic years. The initial market shock of Covid-19 in early 2020 quickly gave way to a golden period for startups and established tech companies, as consumers spent big on gadgets and digital services. Many tech companies used SVB to hold the cash they used for payroll and other business expenses, leading to an influx of deposits. Since deposits into this bank extended to amounts much larger than the demands for it’s loans, it accordingly invested the surpluses, as all other banks do.

When did the problem start?

The seeds of its demise were sown when it invested heavily in long-dated US Govt bonds, including those backed by mortgages. For all intents and purposes, these investments were the safest. But since bonds carry an inverse relationship with interest rates; when rates rise, bond prices fall. So when the US Fed started to hike rates rapidly to combat inflation, SVB’s bond portfolio started to lose significant value.

“Bonds have an inverse relationship to interest rates. When the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa.”

Why did it lead to the collapse?

In short, SVB encountered a classic ‘run on the bank’. The longer version is a bit more complicated. Several forces collided to take down this banker.

First, was the US Federal Reserve equivalent of our RBI, which began raising interest rates a year ago to tame inflation. Leading to higher borrowing costs and sapping the momentum of tech stocks that had benefited SVB. Higher interest rates also eroded the value of the long-term bonds that SVB and other banks gobbled up during the era of ultra-low, near-zero interest rates. Like SVB’s $21 billion bond portfolio was yielding an average of 1.79% — when the current 10-year Treasury yield was about 3.5% plus.

At the same time, venture capital began drying up, forcing startups to draw down funds held by SVB. So the bank was sitting on a mountain of unrealised losses in bonds just as the pace of it’s customer withdrawals was escalating.

If SVB were able to hold those bonds for a number of years till the maturity, then it would have received its invested capital as well as the promised interest back. However, SVB didn’t have enough cash on hand, and therefore, it had to sell its bonds at steep losses, spooking investors and customers. In all, It took just 48 hours between the time it disclosed that it had sold the assets and its collapse.

How is this different from the 2008 crisis?

The US Federal Reserve’s emergency measures over the last weekend have invoked memories of the Lehman Brothers Holding Inc collapse of 2008. However, for now the consensus seems that there won’t be any global systemic impact because of SVB’s, Signature and Silvergate bank’s collapse. The big difference from the 2008 crisis is that the assets that banks are holding this time around consist of US treasury bonds, supposedly the safest in the world. While in the run up to the 2008 Global Financial crisis, banks had majorly invested in so-called subprime assets and opaque derivatives which no one really understood except for may be a few computer gigs.

US Govt’s actions and latest data development?

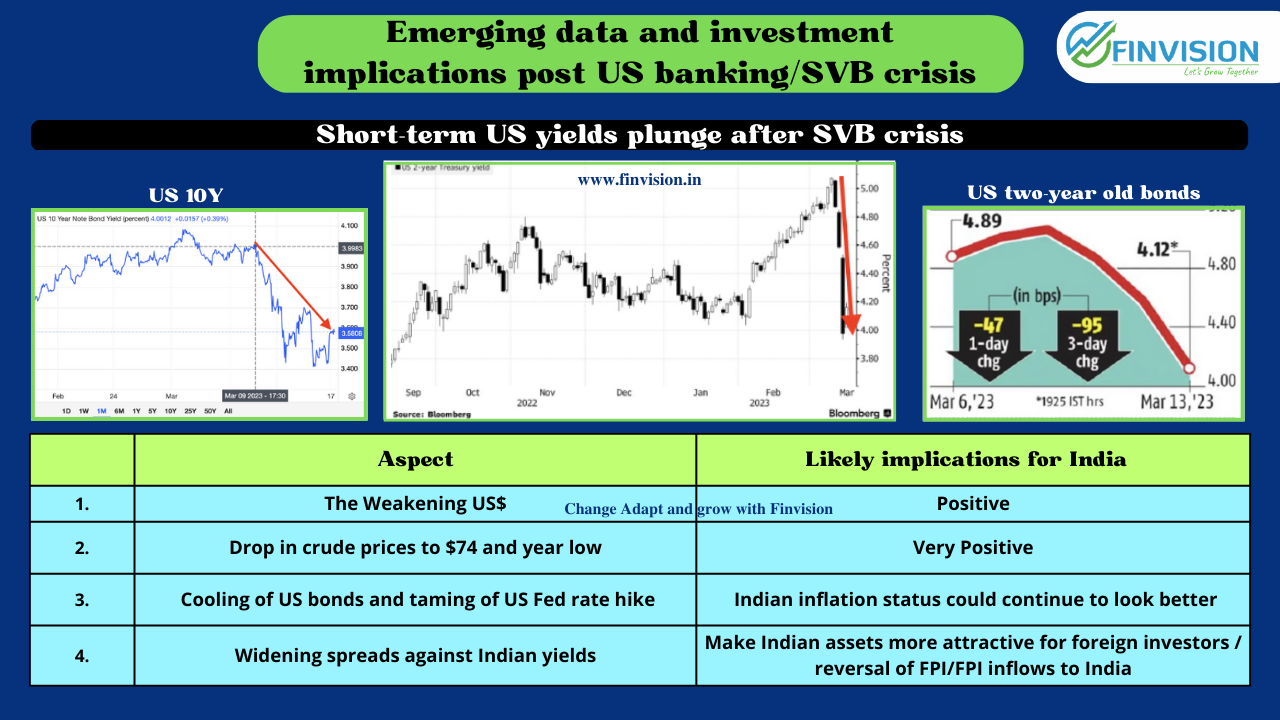

The Quick US Fed action of assuring the depositors of banks should restore confidence among depositors and stop the run on banks knowing that their money is safe. Thus broader contagion and domino effect is unlikely, however, smaller banks that are disproportionately tied to cash-strapped industries like tech and crypto may be in for a rough ride. Also, as the SVB crisis has played out, the data developments have been:-

– The dollar has weakened.

– Fears of a financial crisis have led to a drop in crude prices to $74 per barrel levels i.e. 13 months low.

– Both US 2-year and 10-year bond yields have dropped from 4% plus levels to 3.4%. Probably the biggest and fastest %age decline since the 1980s.

– Heightened Volatility/ Risk and Fear in the investment environment both in equity as well as debt.

In Indian context: Is it a crisis or a blessing in disguise!?

The current decline in Indian markets is purely for the imported reasons and FIIs pulling out more dollars from India after back-to-back collapse of three US banks, as the ripple effect is loud and clear. However, the data developments post the SVB crisis could be actually beneficial for Indian investors.

Action Points:

1. As recommended over last few months too, Conservative and short-term Investors (FD types): Look at Fixed income and carefully selected debt investments.

2. Traders: Step aside as volatility is likely to remain high.

3. Long-term Investors: Have faith, garner courage and invest. But in tranches spread over next few weeks.

Food for thought and Lessons:

1. “All debt is safe”, is the biggest misnomer. The SVB collapsed only and purely for its debt investments going wrong. Also in this instant case, all SVB investments were in the so considered safest US Govt bonds and debt instruments backed by mortgages. So, in a way the safest Govt bonds turned out to be riskiest for SVB.

2. Be extremely careful of your Debt: As damages in debt are permanent.

3. ‘Safe’ in debt just means: In normal circumstances, volatility in debt investments is low.

4. As we write this Blog and exactly three years later, the “YES BANK” moment of 2020 has now happened to the US First Republic Bank. Wherein, the US Fed and other banks have exactly used the strategy that RBI and all our banks employed to save the falling YES Bank in 2020, albeit with a slight difference.

Do participate in these two ongoing polls and help us draw appropriate lessons.

Linkedln: https://www.linkedin.com/feed/update/urn:li:activity:7041330019599626240

Telegram: https://t.me/c/1232864993/539

Happy Investing!!

Don’t forget to share the blog with friends and fraternity and help them benefit.

For further details and awareness, do connect and register to our next webinar: https://forms.gle/Ypzzvf93SQSRtr8b6