For the last six months and to be precise since 19 Oct 2021, markets have been consolidating with heightened volatility. The reasons could be many, however, such movements usually prompt most investors to speculate if a sharp correction is around the corner. Leading to the dilemma of whether one should book profits and protect the gains.

So what should an investor do in times like these? Stay invested and follow the time in the market approach or try timing by exiting the markets for a few days and then reinvest once the investment environment becomes comfortable. Let’s try answering this question by looking at data and the strategies that successfully worked in the past.

Why do the stocks and markets move upwards?

One reason applicable is that the price of any asset rises when there is more demand and less supply. The second reason could be on account of improvement in earnings or simply put the ability of an asset class to earn. This is where stocks and stock markets come in.

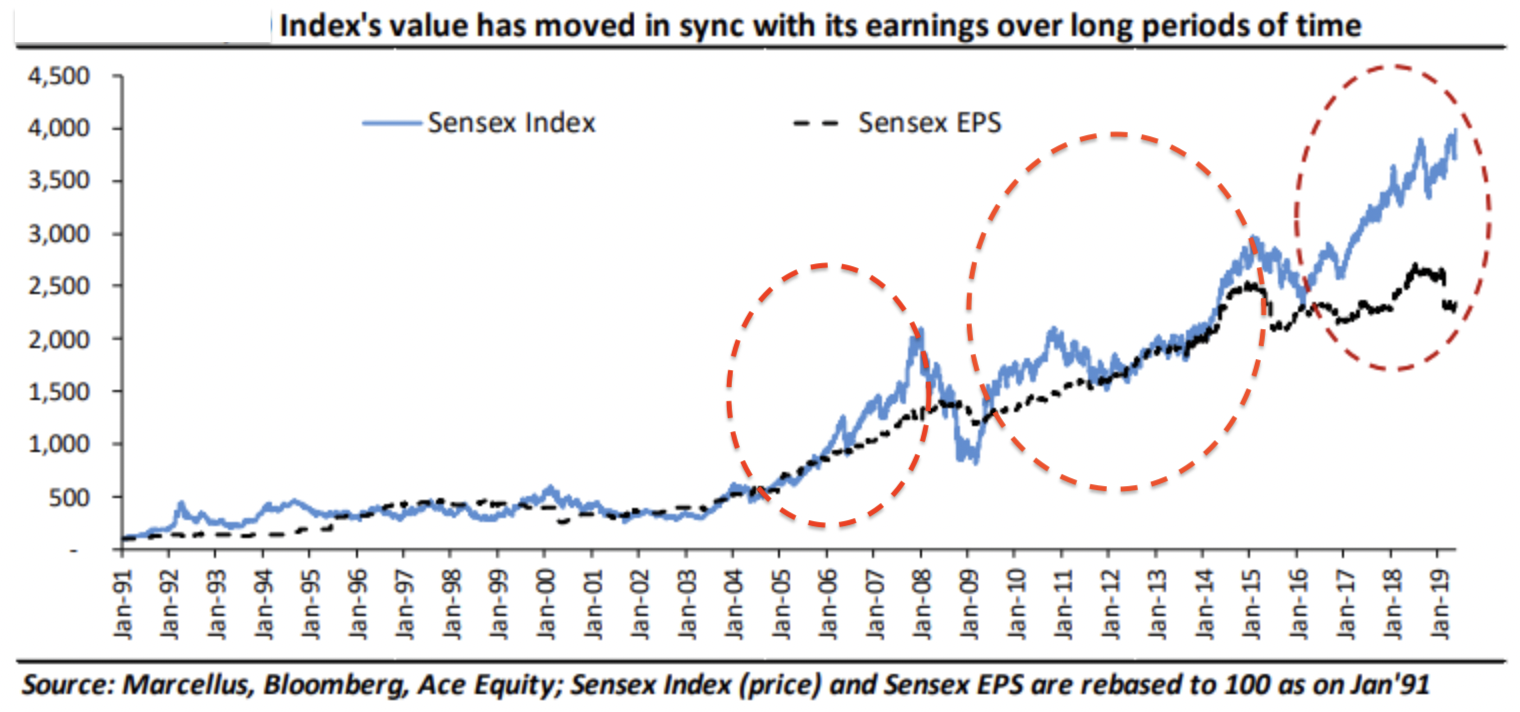

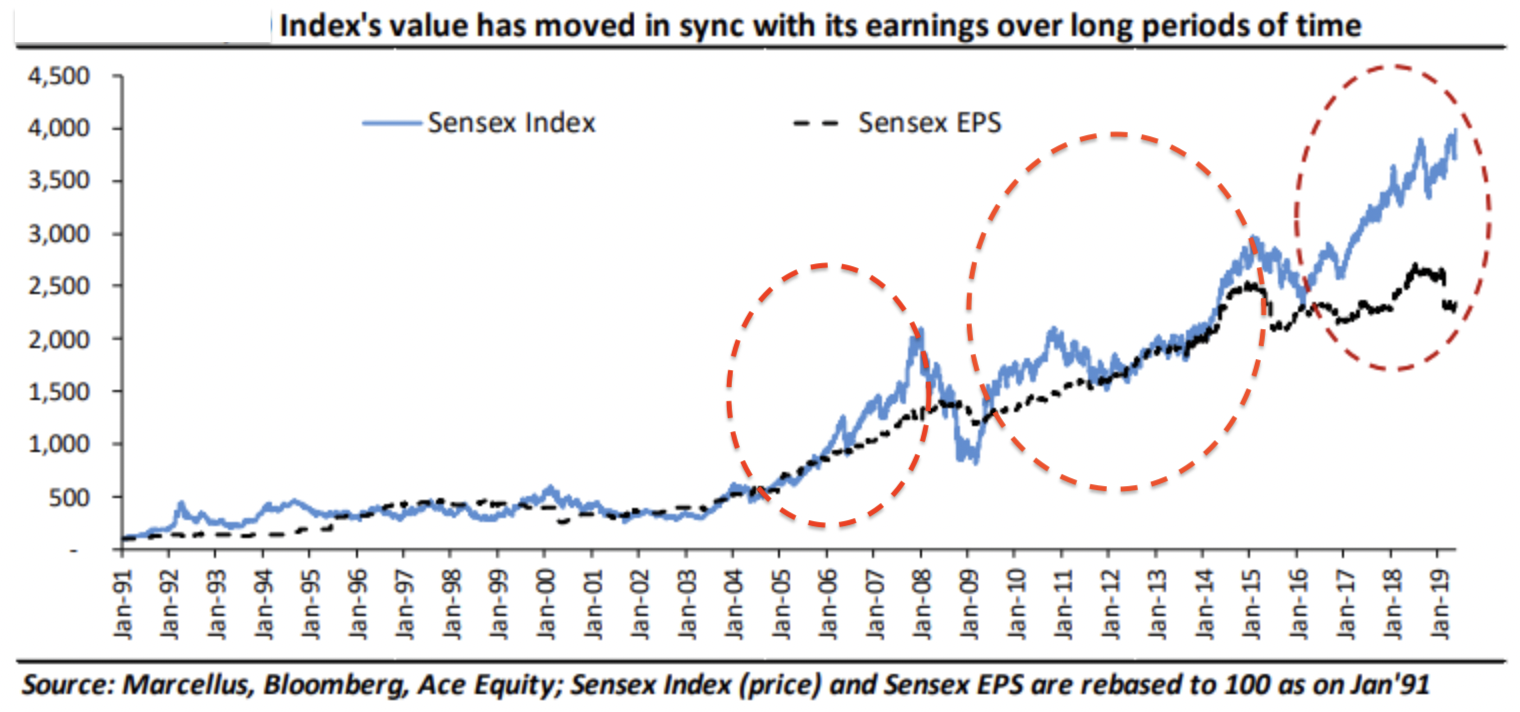

Stocks are simply a representation of ownership in a business. So as long as businesses continue to increase their earnings, the general direction of the stock markets will continue to be up. This is a simple and yet a suitable way to look at your equity investments because it gives you a basic framework for why the stock markets continue to rise. To understand this better let us take the movement in the market index since January 2000 and compare it with the profit earned by its constituent companies i.e. earnings per shares (EPS).

The cost of succumbing to fear and exiting the markets due to uncertainties and media noise:

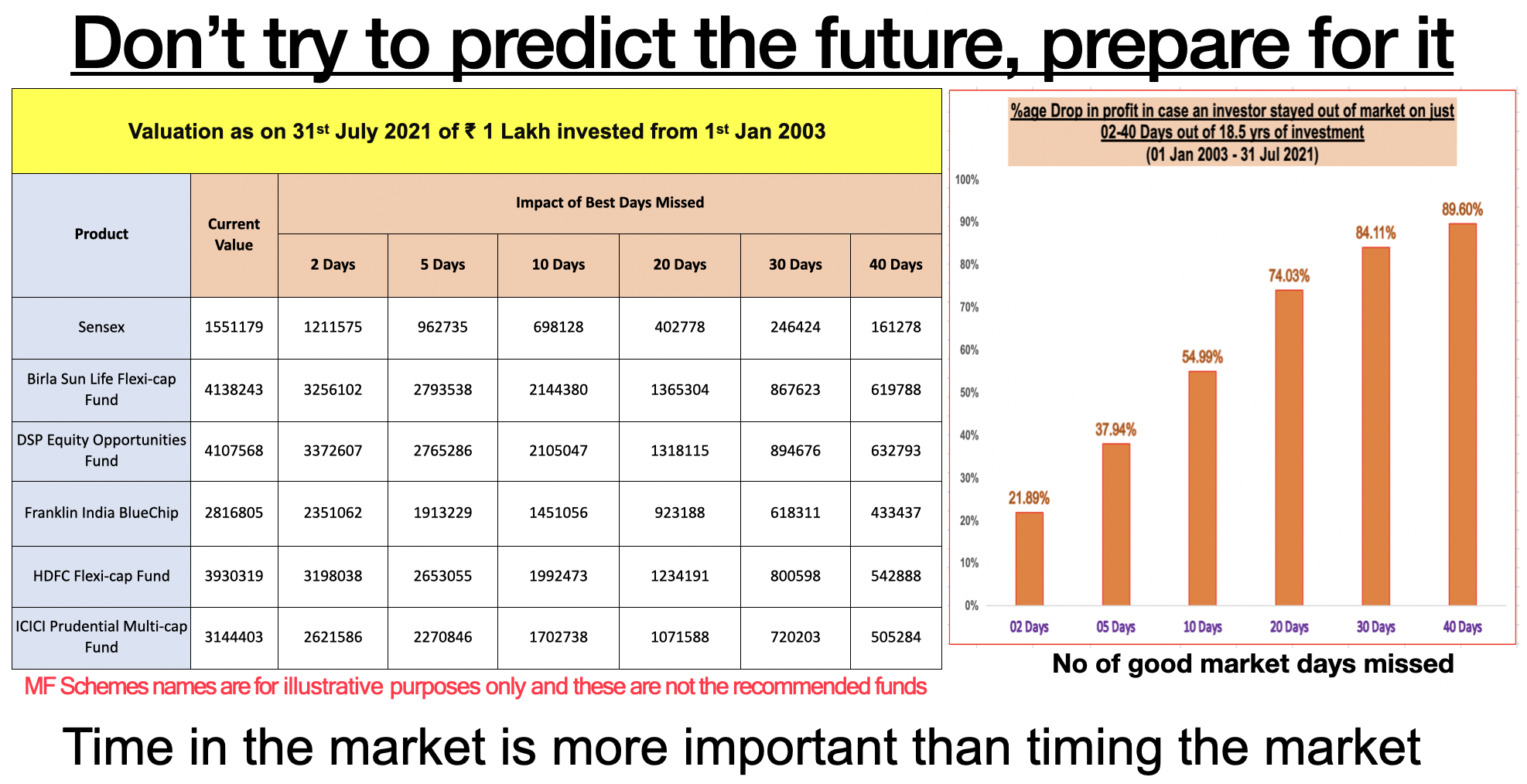

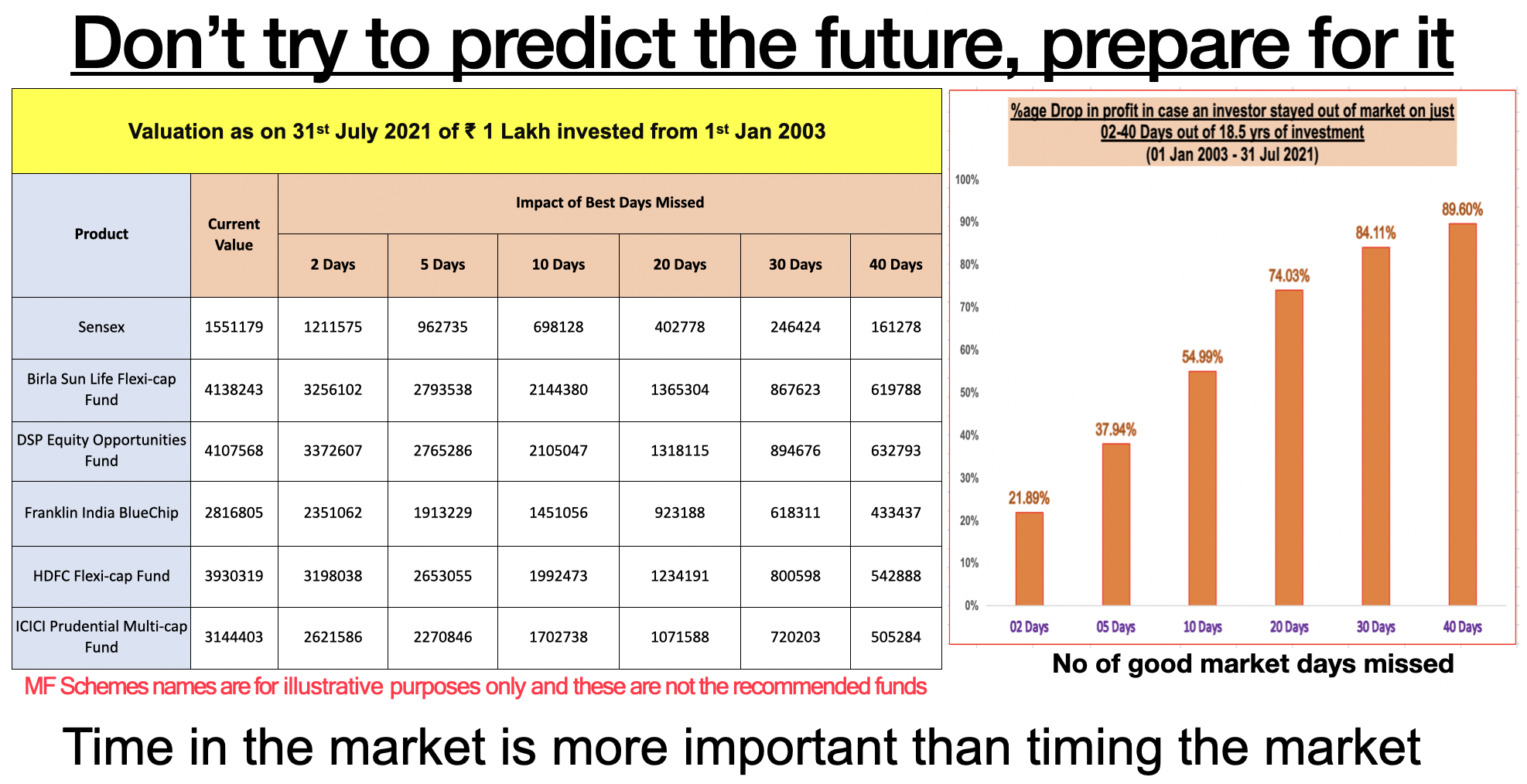

In all corrections and/ or periods of heightened market volatility, it is tough and incredibly hard to convince yourself that things won’t get worse. Investors thus often make the mistake of trying to time the markets by simply selling out of it to reinvest sometime later. But empirical data shows that panicking and dumping equity or equity mutual fund investments during such bouts of volatility is probably the most costly mistake an investor can make. The reason for this is because by doing so, you will not be around to participate in the rebounds. Historically, some of the worst short-term market fluctuations and losses were followed by periods of substantial market recovery. Let’s understand the same with the data and cost of staying out and missing just 02 to 40 days in the last 20 years of market investments.

“Good news and good price seldom come together”

What’s the cause? Beating and outsmarting the stock market is hard. When you’re out of the markets, you might feel safer, but you risk missing out on huge gains. To illustrate: The stock markets bottomed out on March 23, 2020. If you’d been waiting for the perfect investment opportunity and delayed investing because you believed that due to Covid related uncertainties the stock market would further decline. You would’ve missed out on the majority of 140% market returns from the bottom.

Yes, if and when you are able to time the markets correctly, it can be exciting. But the risk of getting it wrong is much greater. NO one can ever be 100% certain of what the direction of the stock market is going to be. Because of this, time in the market is more important than trying to time the markets. Therefore, instead of playing this guessing game, focus on getting the larger market picture right and using strategies like right asset allocation, diversification and periodic re-alignment of portfolios with the developing market environment. These will help reduce your portfolio risk, potentially enhance your returns, and help you stay invested for the long term.

Bottom Line:

It is established that continuity of earnings is what propels the stock markets over the long run. Thus the fear and reactions to the noises and news aren’t really really justified. Moreover, for the long term investors it is important not to develop a trader or speculator’s mentality. This entire practice of frequently trying to time the market based on news, geopolitics, opinions, tweets, interest rates, liquidity, and so on often does a lot more harm than simple rules and data based investment decisions. Also, if you have not reached your long-term financial goals of investment then not investing is certainly not going to help you reach there faster. For all of us in India, since Indian companies are continuously earning more and more profits and the Indian economy continues to do well. Thus the Indian markets have good prospects over the long run. Therefore, staying invested and rather investing more for the long game should be the strategy in such periods of uncertainty and increased market volatility.

Takeaways: Instead of developing a trader or speculator’s mentality, here are few strategies that you as a retail investor should deploy:-

1. Stick to your asset allocation at all times, the same is crucial to achieving optimal risk-adjusted long term returns.

2. Periodically rebalance and realign your portfolios to the investment environment and evolving market conditions. The same will ensure that your portfolio’s risk doesn’t get lopsided and shall enable you to manage drawdowns better.

3. Always investing as per your specific financial goals, risk appetite and investment horizon. Coupled with correct asset allocation, diversification and periodic rebalancing are the tools that will help you weather market uncertainties, downturns and phases of consolidation.

“Having the right investment mix helps strike the right balance between risk and return.“