Given the risk-off sentiment globally, the markets across the world have plunged. It is likely that the current month could go down as the worst month for not only the equities but for all the investment asset classes since March 2020, when markets crashed pandemic’s outbreak. If the ongoing correction drags on, this will be the first big test of patience and resilience of domestic investors, who have consistently invested in stocks either through mutual funds or directly.

Why have the markets mood turned sour? The key factors playing in the markets currently are high inflation, no end in sight to the ongoing Ukraine crisis, relentless selling by the FIIs and abrupt action by central banks to increase the rates indicating a turn in the interest rate cycle.

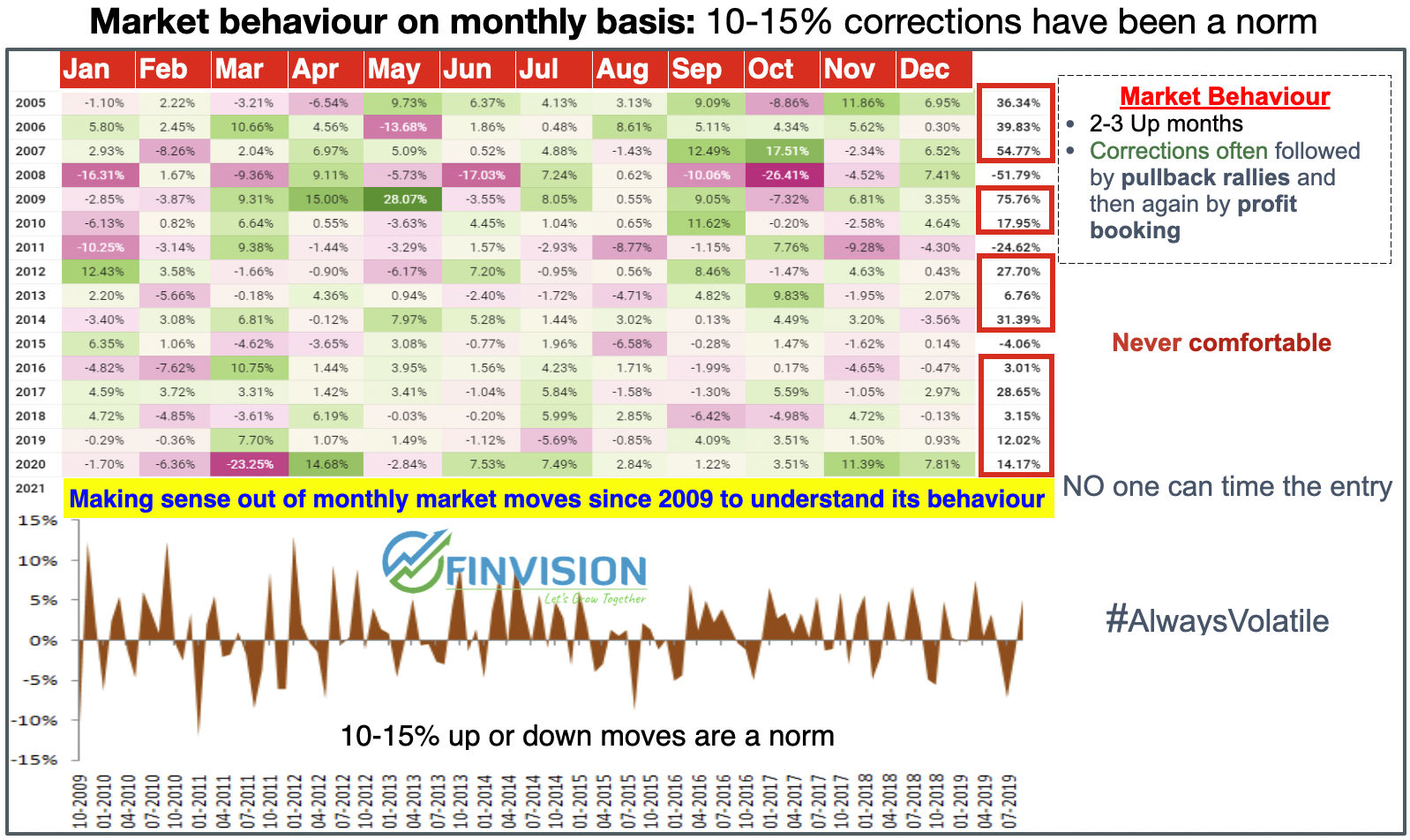

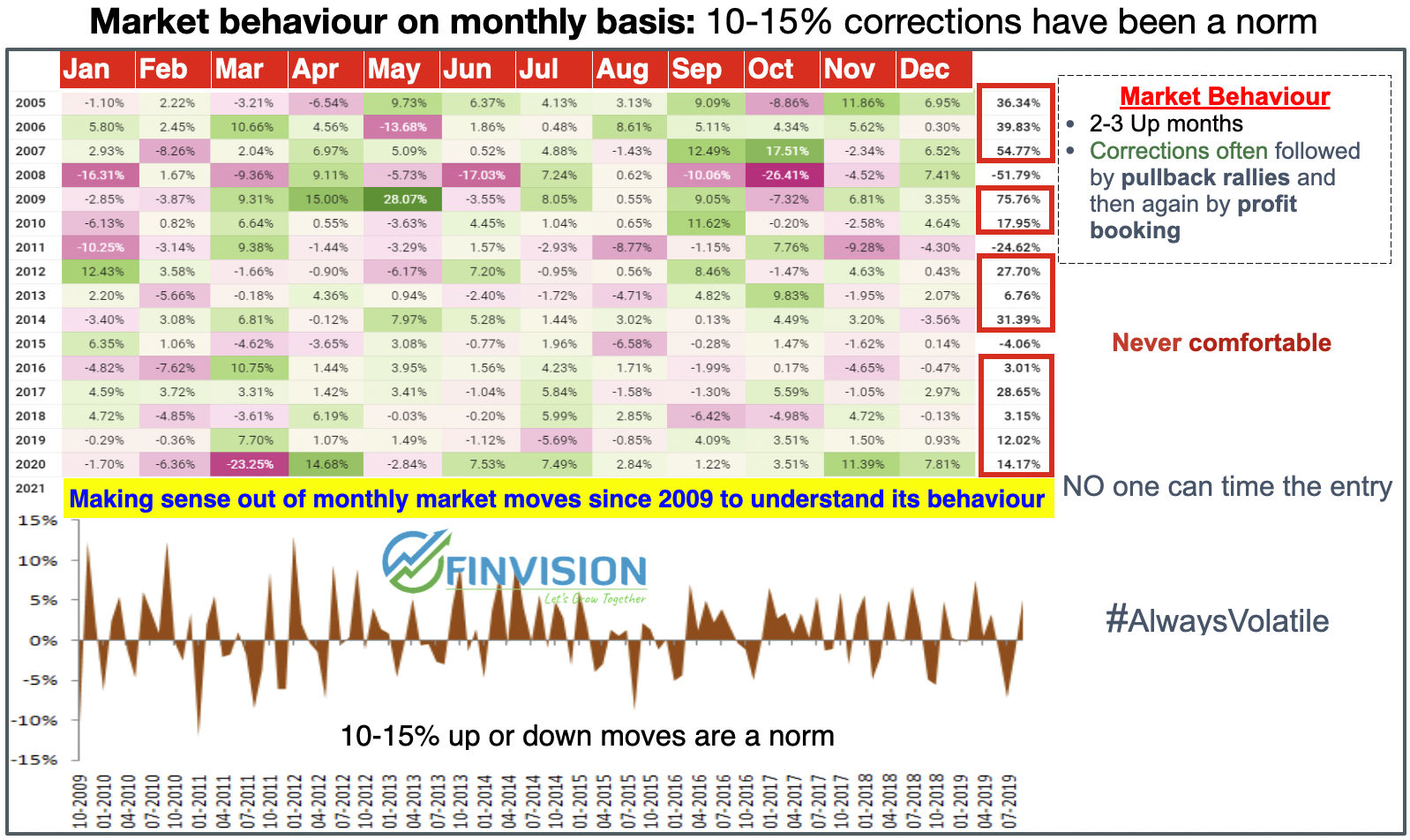

Will the markets continue to go down? At the moment, the markets and rather all investment asset classes(Gold, debt, commodities, etc) including the fancied crypto are reeling under tremendous pessimism and volatility. This risk off and volatility may continue for some more time. However, if you are a long term investor, be assured that there is no need to let this derail your confidence in market investments. Because, when seen from a long term perspective 10-15 % corrections are a norm for the markets. Here is how the indices have performed on a monthly basis since 2005.

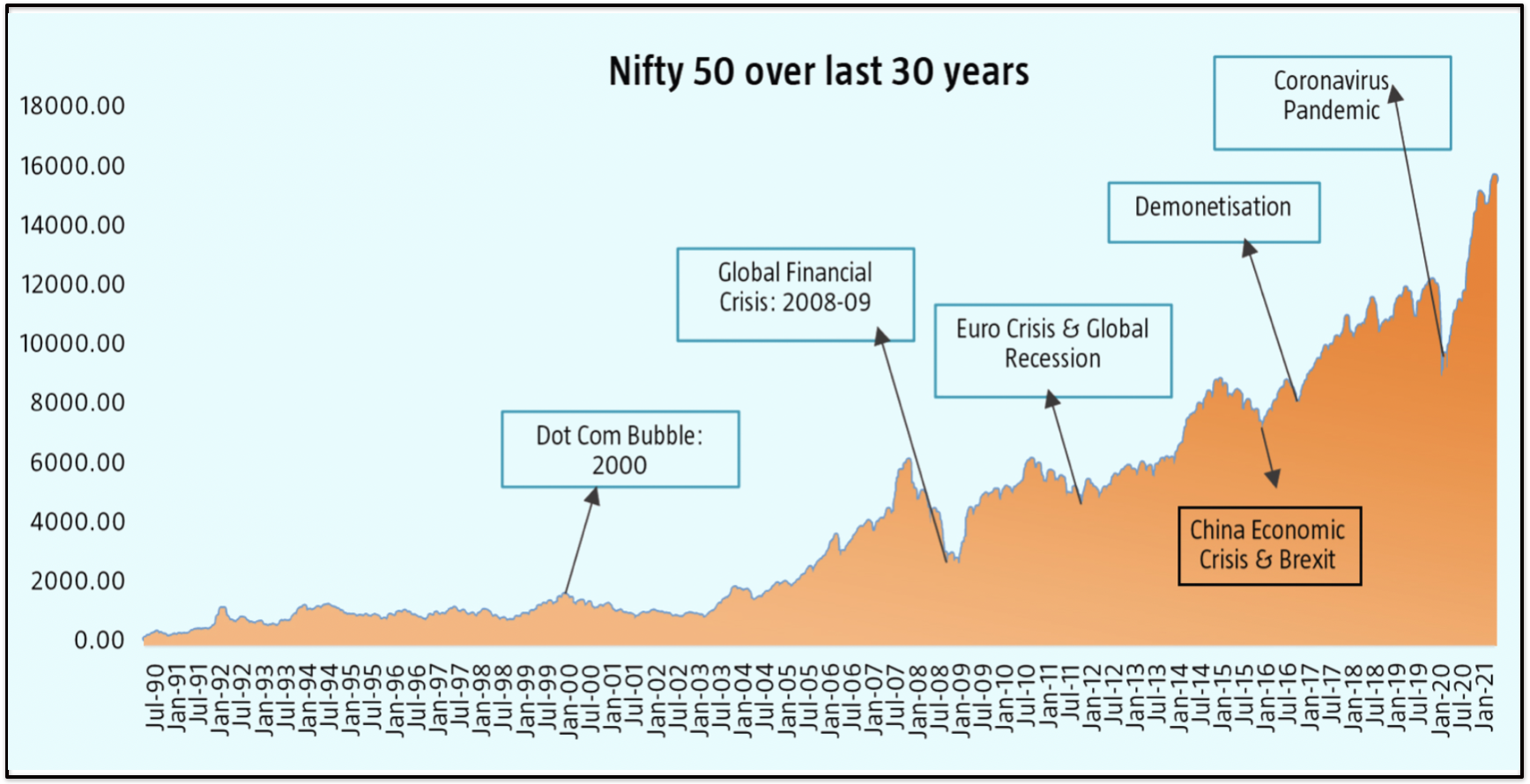

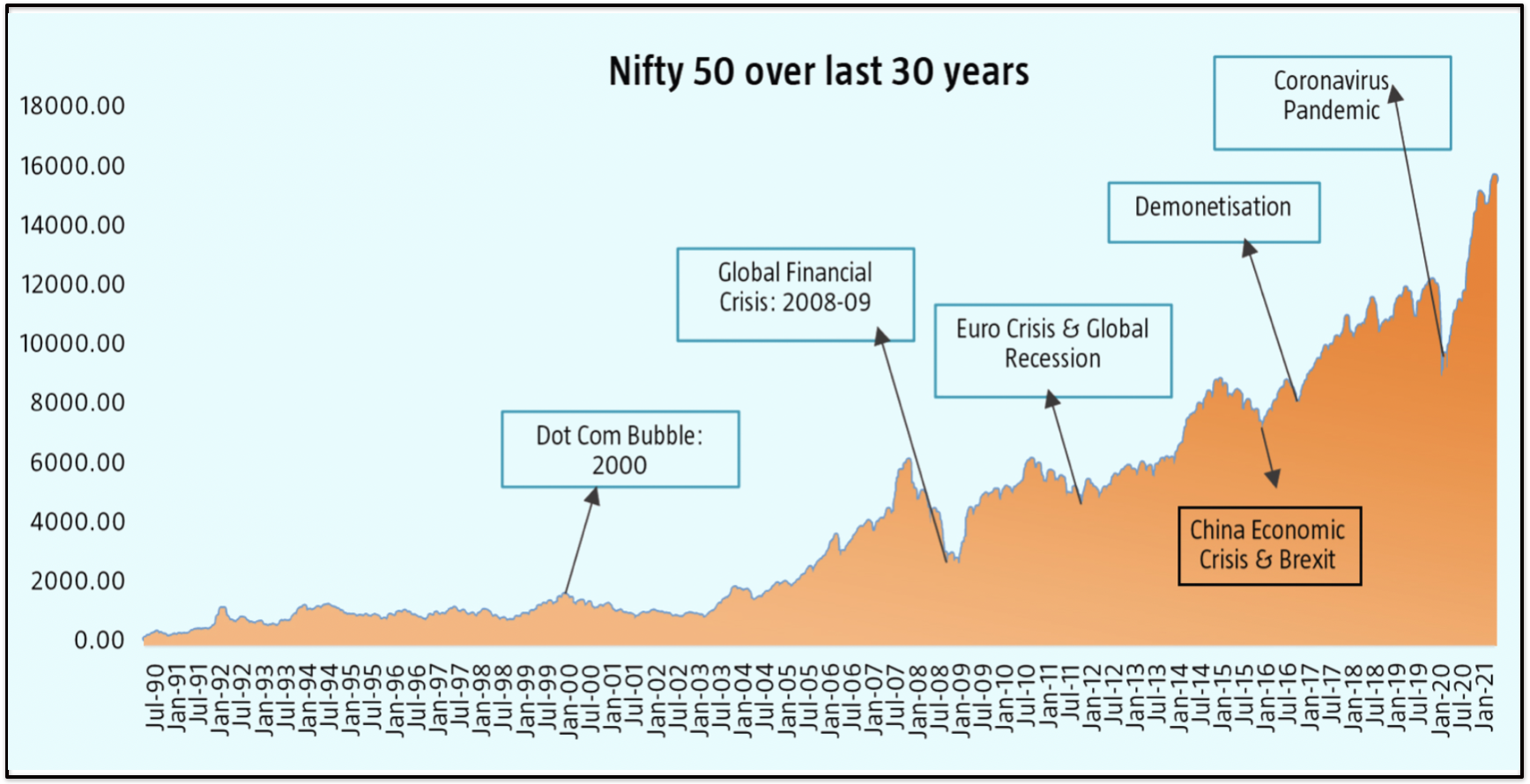

Market behaviour in the long term: The ongoing negative news flow, geopolitical crises, inflationary trend and pessimism on all fronts is not new to the markets. And though the market moment in the short term cannot be predicted. However, markets are known to conquer all such walls of worries. Here is the market chart for the last 25 years.

Impact of rise in interest rates on economy and the Investment asset classes

1. Cost of capital goes up. With the hike in repo rates banks can now avail a higher rate for surplus liquidity parked with the RBI. Thus, the banks start demanding a higher rate for interest from the borrowers. EMIs for loans would rise. Hike in Cash Reserve Ratio reduces the quantum that banks can lend out and consequently higher lending rates.

2. Debt and bond markets: Since, the returns from debt funds have an inverse relationship with interest rates. Hence, on the day the RBI hiked the rates, the debt funds reacted wildly and wiped off their last one year equivalent gains in one day(see chart). With the expected more hikes by the RBI, the returns to existing debt fund investors may continue to be low.

3. Real estate: Though the demand may remain buoyant in the near term. The higher cost of capital, hike in interest rates of loans, amidst rising input costs to the developers. The rate hikes are expected to have its impact on real estate.

4. Equity markets: Equity markets will factor in the changed interest rate environment in quick time and are thus likely to be volatile in the very short-term. However, equity should soon be inching up from here on, as the rising rates doesn’t mean bad news for markets. Empirical data suggests rising interest rates are positive for the markets.

1. Loans will get more expensive and availability of cash will reduce.

2. Debt funds may continue to under perform.

3. For equity: Near-term outlook is volatile, medium-term constructive and longer term positive.

To sum up: Long term investors shouldn’t be swayed with pessimism and such macro challenges, market cycles come and go multiple times in an investor’s journey of achieving financial goals. Stick to your asset allocation plans and use a staggered approach to increase allocation to equities.

The hope: Less access to easy money equals reducing demand and will help bring prices and inflation down.

Buckle up, the ride could continue to be bumpy but it’s important to keep riding.

To know how and where to invest in the ongoing market volatility and inflationary scenario, please contact us.

Link to register for our next webinar scheduled at 7:00 PM on 29 May 2022(Sunday): https://forms.gle/L16SNvWufc1qLrbB6

Happy Investing!

2 Responses

Great analysis. To the point

Thank you for the encouragement sir. Regards