The annual DSOP/PF contributions exceeding ₹5 Lakhs are now subjected to Income Tax(Auth: MoF Notification No 95/2021/F dated 31 Aug 2021).

How does this work? Your DSOP/PF statement will now have two accounts within the provident fund account. Wherein, one will capture the non-taxable portion of contributions and the other shall contain information about the taxable component of your DSOP. For the purpose of calculation both will work as under:-

(a) Non-taxable contribution account shall include aggregate of:

– Closing balance as on 31 March 2021

– Contribution upto ₹5 Lakhs per year(Non taxable contribution)

– Interest accrued on the above or the amount as reduced by the withdrawals, if any, from this account

(b) Taxable contribution account shall be the aggregate of:-

– Contributions made in excess of the threshold limit of ₹5 Lakhs per year

– Interest accrued on above or as reduced by the withdrawal, if any, from such account

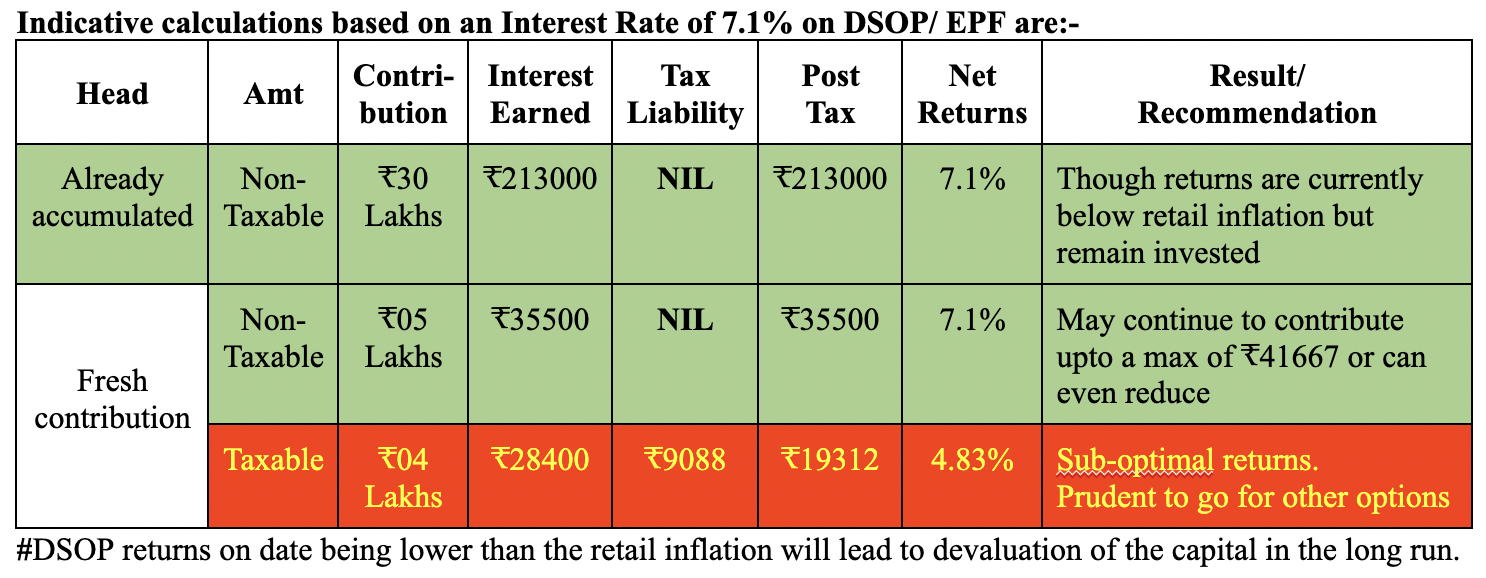

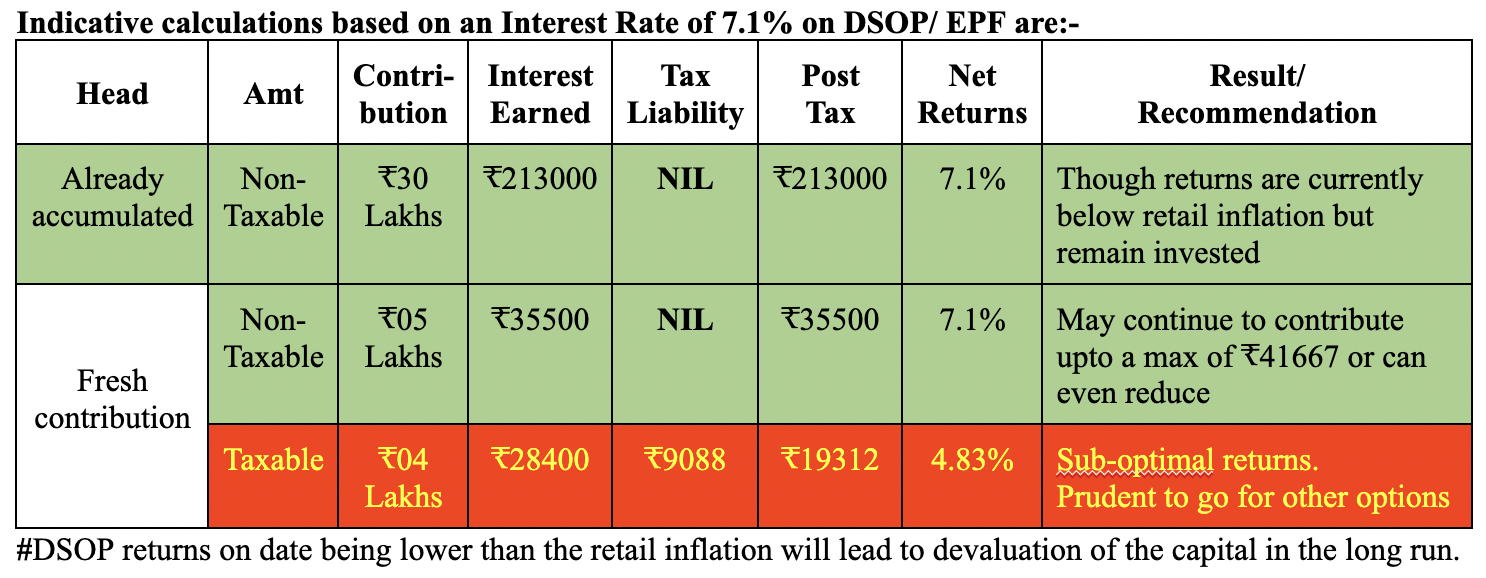

What is the Impact?

The returns from annual contributions to DSOP beyond the threshold limit of ₹5 Lakhs from now on shall be just 4.83% only. The same is much below the prevailing retail inflation rate of approximately 7.5-8%. For illustration: Suppose your Closing Balance as on 31 Mar 2021 was ₹30 Lakhs. You are in the 30% tax bracket and monthly DSOP subscription is ₹75,000 per month(ie ₹9 Lakhs annual).

1. Main features of the commonly preferred/ traditional and modern investment instruments are:-

Investment Instrument | PostTax Returns | Risks Associated | Liquidity | Ability to Beat Inflation |

FD/RD/PORD/NSC/ PPF/Corporate FD etc | 3.6-6% | Interest rate and Reinvestment risk | Limited/ Fixed date maturity | NO |

Tax Saving Mutual Funds | Historical >15% | Market Risk | Full after 3 yrs | YES |

Equity Mutual Funds | Historical >15% | Market Risk | Full | YES by a wide margin |

How are Equity Linked Saving Schemes(ELSS) & Mutual Funds better than DSOP?

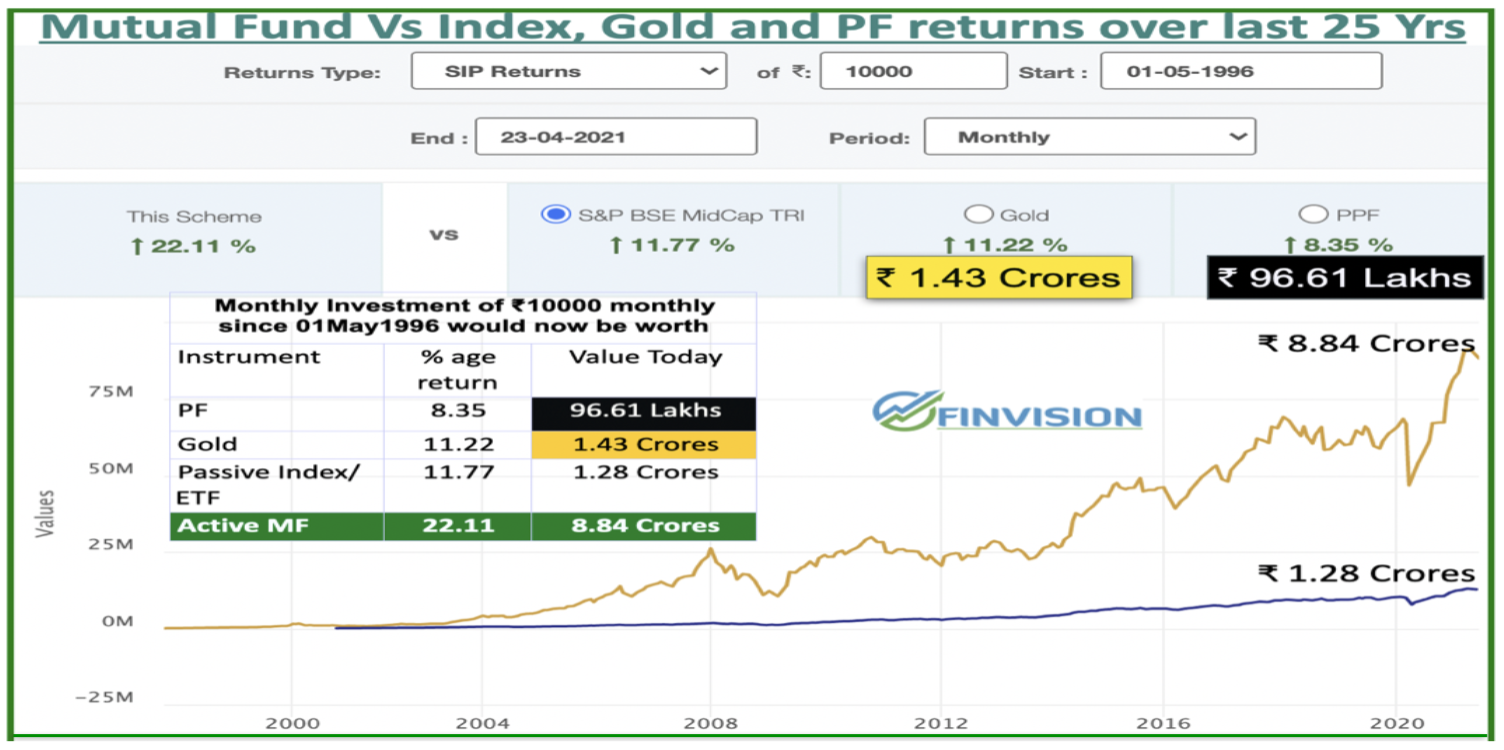

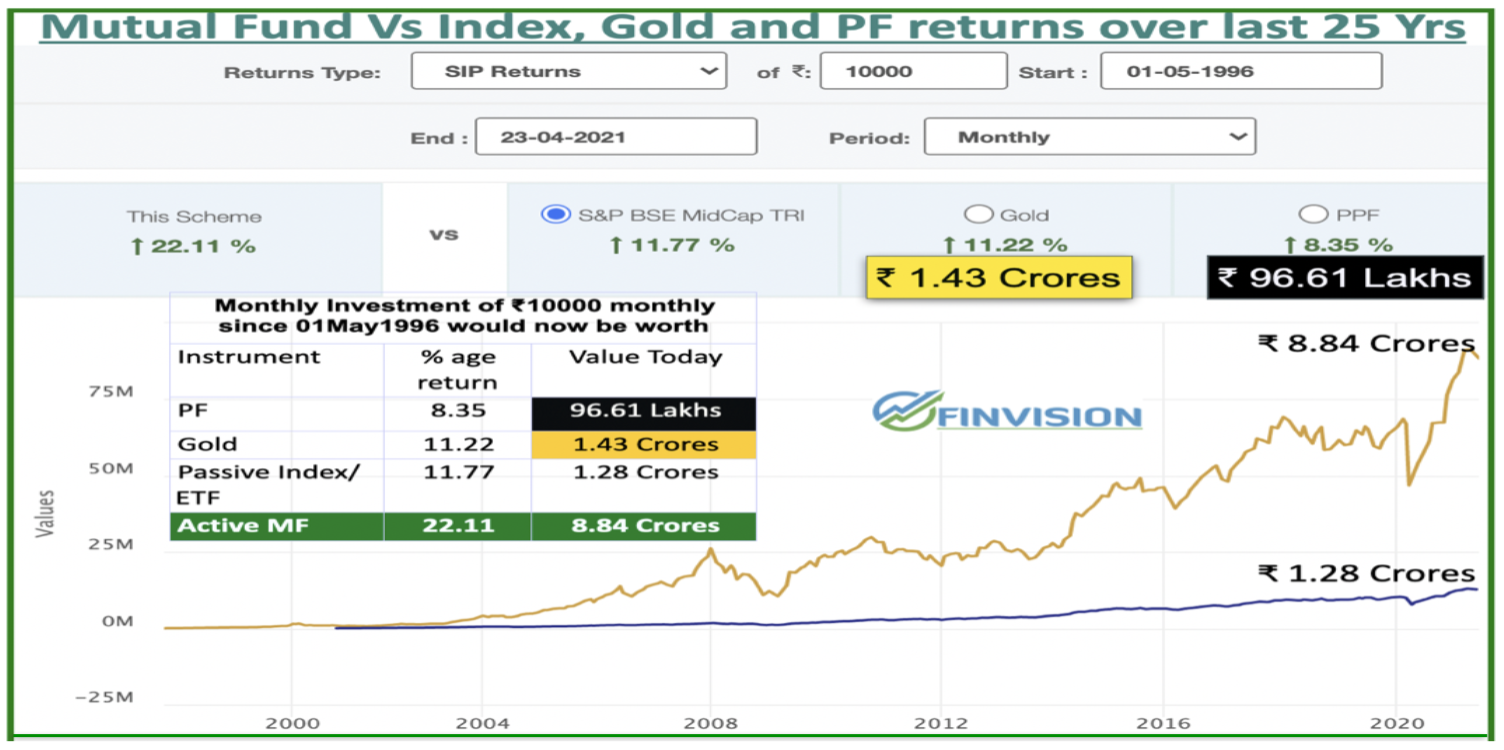

N.B. Above chart clearly indicates that in the last 25 yrs, investments in ELSS and actively managed Mutual Funds have generated 6-8 times more gains than the DSOP, Provident Fund, passive index funds, ETFs and the often preferred traditional investment schemes.

Tax Saving/ELSS Mutual Funds. Tax saving benefits on subscription of upto ₹1.5 Lakhs each year under IT section 80C(similar to DSOP) and lowest lock-in period of 03 yrs only. Option to invest as Lump sum or through monthly SIP, and potential to create wealth in the long-term as these are equity market linked.

Equity Mutual Funds. NO lock-in at all. Better growth with upto ₹1 Lakhs of tax free gains each year and effectively less than 10% tax on gains irrespective of your income tax bracket. Ideal for investors in the 20% & 30% tax bracket.

Recommendations

1. Limit or reduce your contributions in DSOP/PF to a maximum of ₹5 Lakhs per year.

2. Avoid withdrawals from the already accumulated DSOP/PF corpus as it continues to earn 7.1% Tax free returns.

3. Invest the saved amount into market instruments and actively managed Mutual Funds, as they give better post tax returns.

“An investment instrument should provide adequate Liquidity and Inflation beating returns(>8%)”

For further details on smart and tax efficient investment options, please feel free to contact at +91-7508055826/ 9654341212.